The latest DENTIUM Q3 2025 earnings report has sent ripples through the investment community, signaling a significant ‘earnings shock.’ The dental implant specialist’s preliminary results for the third quarter of 2025 fell drastically below market consensus, raising critical questions for current and prospective shareholders. Is this a temporary setback, or does it point to a fundamental shift in DENTIUM’s growth story? This comprehensive analysis will dissect the financial data, explore the underlying causes, and provide a clear DENTIUM investment strategy to navigate the path forward.

Investors are now faced with a crucial decision: how to react to disappointing performance without letting short-term market volatility dictate long-term financial goals. We’re here to provide the clarity you need.

Breaking Down the DENTIUM Q3 2025 Earnings Report

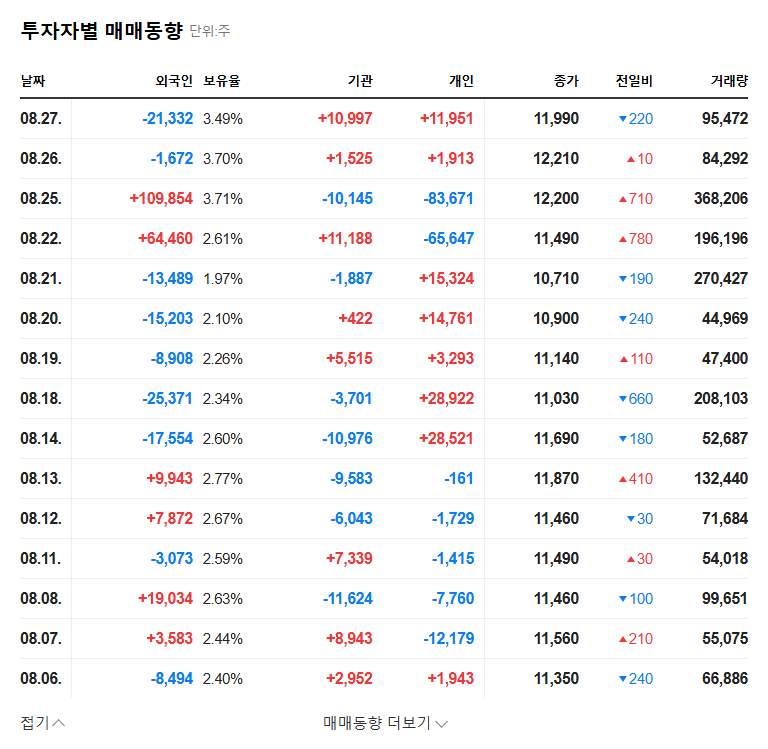

The numbers from the preliminary DENTIUM earnings report for Q3 2025 were stark. The company posted revenues of 78.2 billion KRW, an operating profit of 12.5 billion KRW, and a net income of 4.0 billion KRW. These figures represent a significant miss compared to market expectations, which were pegged at 91.2B KRW, 19.4B KRW, and 12.5B KRW, respectively. This translates to performance being 14% below revenue forecasts, 36% below operating profit forecasts, and a staggering 68% below net income expectations.

When compared to the same period last year (Q3 2024), the decline in both revenue and operating profit is even more concerning for investors, indicating a potential reversal of its strong growth trajectory. The sharp contraction in both operating and net profit margins further exacerbates these worries. For investors looking for the official numbers, the filing can be found directly from the source. Official Disclosure: Click to view DART report.

Why the Underperformance? A Fundamental Analysis

To formulate an effective DENTIUM investment strategy, we must understand the root causes of this slump. The issues appear to be multi-faceted, stemming from both internal operational challenges and external market pressures.

Key Challenges and Headwinds

- •Decreased Production Efficiency: A critical red flag is the declining utilization rate of the Gwanggyo plant. It has fallen from a healthy 87.1% in 2023 to just 54.9% in the first half of 2025. This suggests significant operational issues, leading to higher fixed costs per unit and a potential inventory buildup.

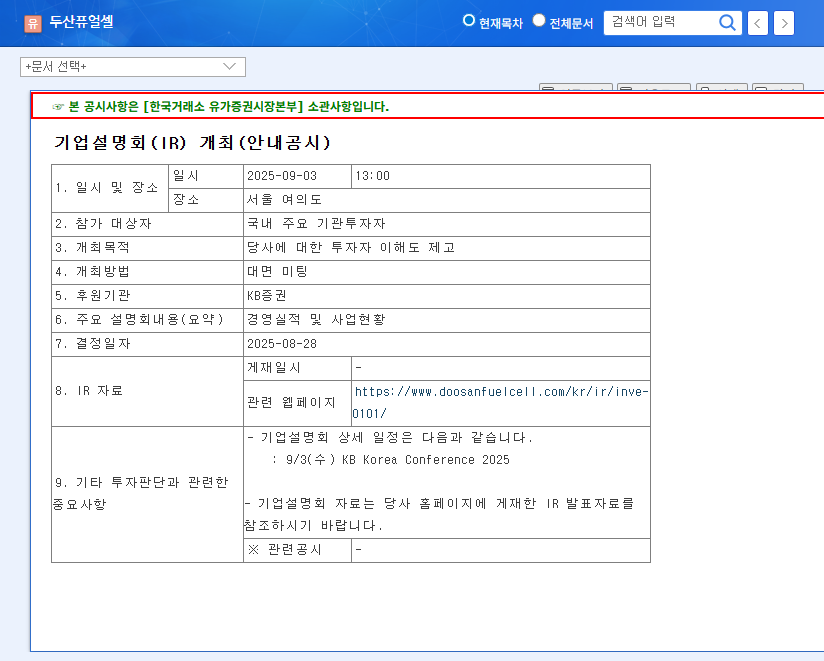

- •Uncertainty in New Ventures: The strategic pivot into the Solid Oxide Fuel Cell (SOFC) business is a long-term play, but it introduces short-term uncertainty. The path to commercialization and profitability is long and subject to regulatory and economic variables, which may be weighing on investor confidence.

- •Currency Fluctuations: With over 80% of its sales coming from overseas, DENTIUM is highly exposed to exchange rate volatility. While a strong USD can be beneficial, sudden shifts in the Won, Euro, or Chinese Yuan can directly impact profitability.

Core Strengths and Long-Term Drivers

Despite the concerning quarter, a holistic DENTIUM stock analysis reveals that the company’s foundational strengths remain intact.

- •Dominant Core Business: The dental implant segment, which constitutes 88% of revenue, continues to benefit from global trends like aging populations and increasing dental health awareness. Its expansive network across 70 countries, particularly its strong foothold in the high-growth Chinese market, provides a stable base.

- •Digital Dentistry Expansion: DENTIUM’s focus on digital dentistry, including CBCT scanners and CAD/CAM solutions, positions it well to capture future market share. This high-tech segment offers higher margins and creates a sticky ecosystem for its customers. For more on this trend, see our analysis of the digital dentistry market.

- •Shareholder-Friendly Policies: The company’s plan to cancel a significant portion of its treasury shares over three years is a clear positive for shareholder value, aiming to increase earnings per share and support the stock price over the long term.

A Prudent DENTIUM Investment Strategy for 2025

Given the conflicting signals, a balanced and cautious approach is warranted. The market’s short-term reaction is likely to be negative, with increased selling pressure and a potential stock price correction. However, long-term investors should look beyond the immediate noise. For further reading on investment principles, Investopedia offers excellent resources on fundamental analysis.

Short-Term Outlook: Caution is Key

In the immediate aftermath of the DENTIUM Q3 2025 earnings release, a defensive stance is advisable. While a sharp drop might present a ‘buy the dip’ opportunity, it’s prudent to wait for signs of stabilization and a clear explanation from management regarding the operational issues before committing new capital.

Mid-to-Long-Term Outlook: Watchful Optimism

The long-term investment thesis hinges on management’s ability to address the production inefficiencies and provide a clear roadmap for future growth. The core business remains strong, but investors will need reassurance. Key points to monitor in upcoming quarters include:

- •Recovery of the Gwanggyo plant’s utilization rate.

- •Performance trends in key overseas markets, especially China.

- •Tangible progress and clear financial projections for the new SOFC energy business.

In conclusion, while the Q3 earnings shock is a significant concern that warrants immediate caution, it doesn’t necessarily invalidate DENTIUM’s long-term potential. A ‘Neutral’ rating is appropriate for now. The coming months will be crucial in determining whether this quarter was an anomaly or the beginning of a more challenging chapter for the company.