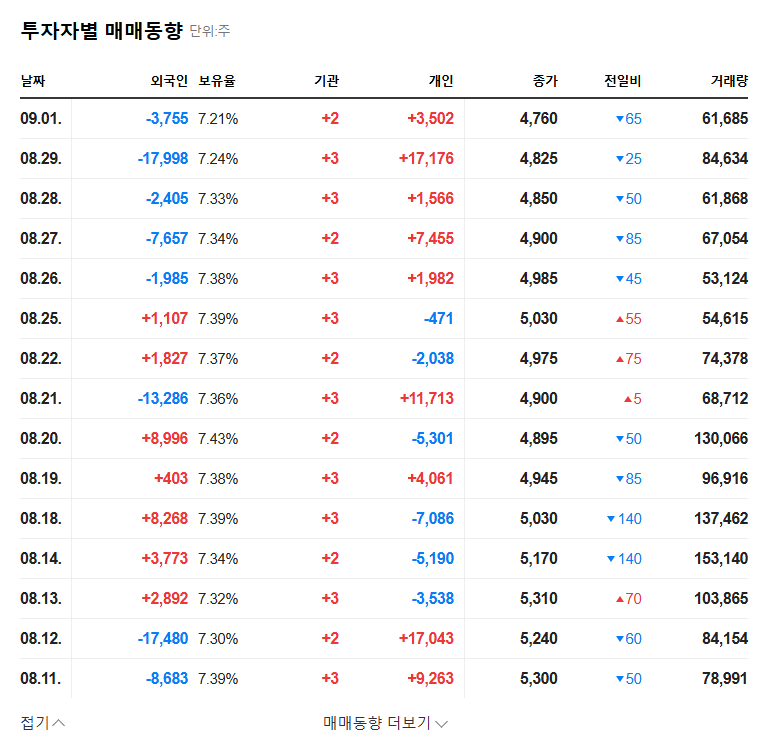

1. What Happened? : NJET CEO Byun Do-young Reduces Stake by 2.4%

NJET CEO Byun Do-young announced on September 25, 2025, a 2.4% decrease in his stake, from 34.48% to 32.08%. The reasons for the decrease were cited as over-the-counter trading and gifts by related parties, resignation of executives, and exercise of stock options. While stating that the purpose of holding the shares remains ‘influencing management,’ the actual decrease raises several questions in the market.

2. Why is it Important? : Potential Management Changes and Deteriorating Market Sentiment

The CEO’s stake reduction suggests the possibility of management changes and could negatively impact investor sentiment. This, combined with NJET’s recent poor performance (decline in sales and net loss in the first half of 2025), could exacerbate downward pressure on the stock price. Furthermore, over-the-counter trading by related parties hints at the possibility of further stake changes, amplifying investor anxiety.

3. So What Will Happen? : Short-term Volatility Increase, Focus on Mid- to Long-term Fundamental Improvement

Increased stock price volatility is expected in the short term. Investors should carefully monitor the announcement details and market reactions. In the mid- to long term, NJET’s fundamental improvement will determine the stock price direction. Clear explanations from management and efforts to improve performance will play a crucial role in restoring market confidence.

4. What Should Investors Do? : Maintain a Wait-and-See Approach, Monitor Information Disclosure and Fundamentals

- Short-term Investors: Maintain a wait-and-see approach, explore technical rebound points in case of further decline.

- Mid- to Long-term Investors: Continuously monitor information disclosure related to stake changes, management communication, fundamental improvement, and re-evaluate valuation.

Frequently Asked Questions (FAQ)

How will CEO Byun Do-young’s stake sale affect NJET’s stock price?

In the short term, it is likely to put downward pressure on the stock price. However, the mid- to long-term impact will depend on NJET’s future performance and management strategy.

Should I invest in NJET?

Caution is advised at this point. It’s recommended to make investment decisions after confirming additional information disclosure and changes in fundamentals.

What is the outlook for NJET?

NJET has growth potential based on its unique EHD technology, but currently faces challenges such as poor performance and management uncertainty. The future outlook can vary significantly depending on management’s efforts and market conditions.