A significant legal challenge has cast a shadow over KOREA ASSET IN TRUST Co., Ltd (123890), a key player in the real estate trust sector. The unfolding KOREA ASSET IN TRUST lawsuit involves a staggering claim of ₩192.1 billion, representing nearly 20% of the company’s total assets. This development has sent ripples through the investment community, raising critical questions about the company’s financial stability, future profitability, and the trajectory of its stock price. For investors, navigating this period of uncertainty requires a clear and comprehensive understanding of the situation. This detailed analysis will dissect the lawsuit, evaluate the company’s fundamental health, and provide a strategic outlook for both the short and long term.

The ₩192.1 Billion Lawsuit: A Closer Look

On October 27, 2025, a large-scale lawsuit was filed against KOREA ASSET IN TRUST in the Seoul Central District Court. The plaintiffs, a group of 465 individuals led by Mr. Noh, are seeking ‘cancellation, termination, and restitution of sales contracts,’ with the claim amount recently increasing to ₩192.1 billion. This figure is significant not just for its absolute size but for its scale relative to the company’s financial base—it equals 19.48% of its assets. The official disclosure of this event can be found in the company’s public filing. (Source: Official DART Report).

The core of the company’s defense rests on the argument that its liability is confined to the specific trust assets associated with the project in question. However, the plaintiffs are challenging this limitation, creating a high-stakes legal battle with profound implications.

The critical question for investors is whether this massive liability will be firewalled within the trust’s assets or if it will breach the corporate shield, directly impacting KOREA ASSET IN TRUST’s proprietary funds and overall financial health.

Company Under Pressure: KOREA ASSET IN TRUST Analysis

To understand the potential impact of the KOREA ASSET IN TRUST lawsuit, we must first assess the company’s underlying financial condition based on its H1 2025 report.

Strong Financial Soundness (Pre-Lawsuit)

The company entered this legal battle from a position of apparent financial strength. Key indicators point to robust health:

- •High Capital Ratio: Its Operating Net Capital Ratio stands at 280%, well above the regulatory minimum of 150%, suggesting a solid capital buffer.

- •Exceptional Liquidity: A KRW Liquidity Ratio of 5,071% indicates a very strong ability to meet short-term obligations without stress.

- •Stable Capital Structure: Capital accounts for approximately 56% of the balance sheet, reflecting stability.

Warning Signs: Declining Profitability

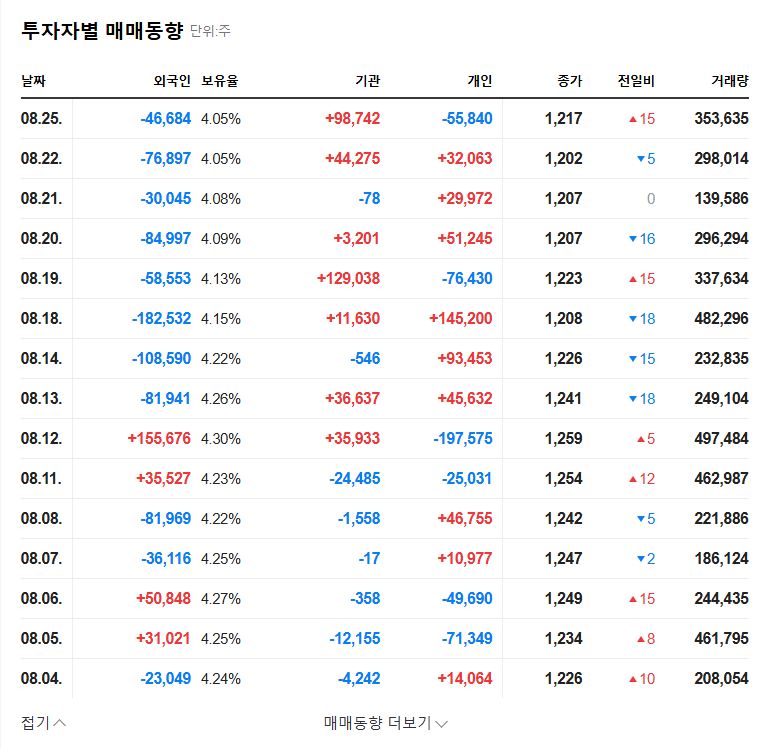

Despite its sound balance sheet, profitability has been on a downward trend. A challenging real estate market, exacerbated by sustained high interest rates, has squeezed margins. Consolidated operating revenue, operating profit, and net income have all seen year-over-year decreases. The primary driver of this decline is a reduction in commission income, particularly from its core land trust business. For more information on navigating market downturns, check out our guide to investing in real estate during high-interest periods.

Emerging Financial Risks

Even before this lawsuit, certain risks were becoming more prominent. The company’s debt levels have been increasing, which could raise its financial burden in a tough economic climate. More concerning is the sharp rise in the non-performing loan (NPL) ratio to 52%. While this may relate to specific trust assets, it signals a need for diligent monitoring of overall asset quality.

Navigating the Uncertainty: Investor Outlook & Strategy

The lawsuit introduces a major variable into the valuation of KOREA ASSET IN TRUST stock. Investors must adopt a cautious and informed approach, considering both short-term volatility and the long-term fundamental picture.

- •Monitor the Lawsuit’s Progress: The single most important factor is the court’s interpretation of the company’s liability. Any news regarding the acceptance or rejection of their limited liability defense will be a major catalyst for the stock.

- •Assess Risk Management: Observe how the company communicates its contingency plans. Transparent disclosure and proactive risk management can help restore investor confidence.

- •Evaluate Core Business Health: Look beyond the lawsuit. Is the company adapting to the new real estate market reality? Are there efforts to diversify revenue streams away from the struggling land trust segment?

In the short term, the uncertainty will likely weigh heavily on the stock price. A negative ruling could cause severe damage to the company’s equity and long-term reputation, as trust is the bedrock of its industry. Conversely, a decisive win would remove this overhang and allow the stock to be re-evaluated based on its fundamentals in the current market.

Frequently Asked Questions (FAQ)

What is the core claim of the lawsuit against KOREA ASSET IN TRUST?

The plaintiffs are demanding the ‘cancellation, termination, and restitution of sales contracts,’ with a total claim of ₩192.1 billion, which is nearly 20% of the company’s total assets.

What is the worst-case financial impact of this lawsuit?

If the court rules that the company is liable with its own proprietary assets (not just the trust assets), a loss of ₩192.1 billion would directly reduce net income and total equity, severely damaging key financial metrics like ROE and PER.

How might this lawsuit affect the KOREA ASSET IN TRUST stock price?

The ongoing uncertainty is a significant negative catalyst, likely causing downward pressure and increased volatility. The final outcome will be a major determinant of the stock’s long-term direction; a loss could be devastating, while a win could remove a major obstacle.