What Happened?

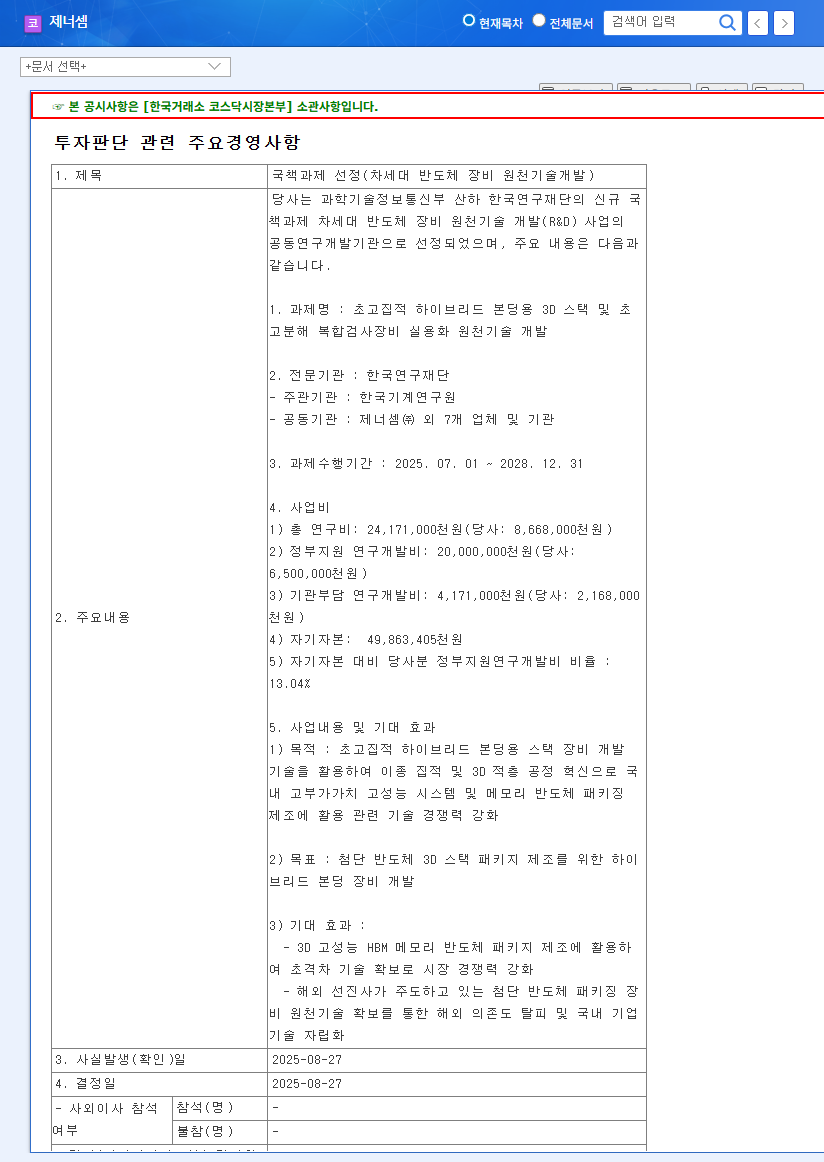

Xenersem has been selected as a joint research and development organization for a national project spearheaded by the Korea Research Foundation under the Ministry of Science and ICT. The project focuses on ‘Development of practical core technology for ultra-high-density hybrid bonding 3D stacking and ultra-high resolution composite inspection equipment,’ and will run for three years and six months, starting in July 2025. Xenersem will be responsible for $65 million of the total $170 million research budget.

Why Does It Matter?

This selection is expected to have several positive effects on Xenersem. Securing key technology for next-generation semiconductor packaging will enhance Xenersem’s technological competitiveness and secure future growth momentum. The substantial R&D funding allows for stable research activities, and the government support reduces financial burdens. It will also contribute to portfolio diversification, synergy creation, and enhanced reputation.

What’s Next?

This grant is expected to act as a significant momentum, boosting Xenersem’s long-term growth potential. Given the growth potential of the next-generation semiconductor packaging market, securing this technology could positively impact Xenersem’s corporate value. However, investors should consider the inherent uncertainties in R&D and the competitive landscape, focusing on long-term R&D outcomes and commercialization capabilities rather than short-term stock fluctuations.

Action Plan for Investors

- Monitor the progress of the national project and technological developments.

- Assess potential synergies with partner organizations and technology transfer possibilities.

- Check for new orders and commercialization plans.

- Stay informed about overall trends in the semiconductor post-processing equipment market.

Frequently Asked Questions

What is the core of this national project?

The core is the ‘Development of practical core technology for ultra-high-density hybrid bonding 3D stacking and ultra-high resolution composite inspection equipment.’

How much funding did Xenersem receive?

Xenersem will receive $65 million in government funding as part of the larger $170 million project budget.

How will this grant affect Xenersem’s stock price?

While a positive long-term impact is expected, investors should focus on long-term R&D performance and commercialization capabilities rather than anticipating immediate stock price surges.