What’s Happening? Ildong to Announce Phase 1 Trial Results

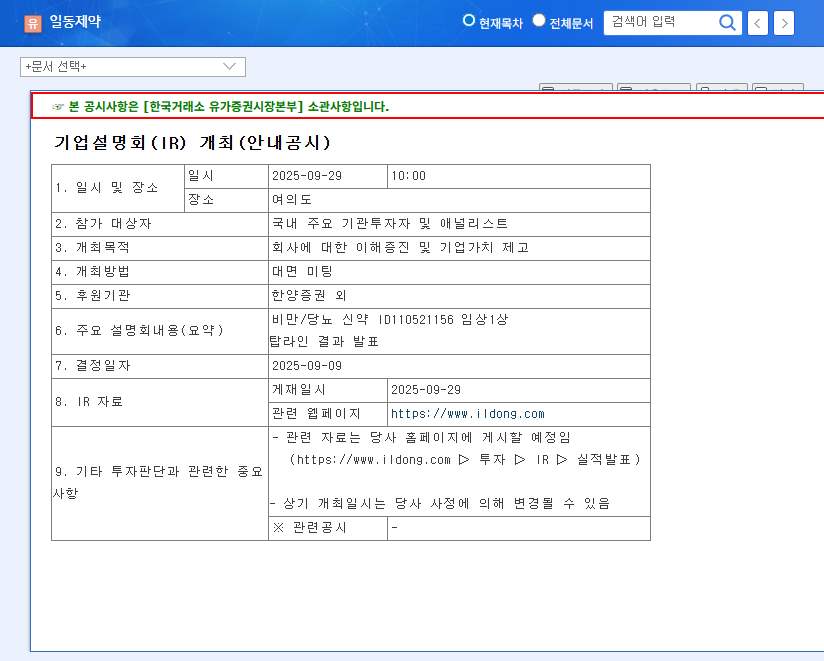

Ildong Pharmaceutical will announce the topline results of its Phase 1 clinical trial for the obesity/diabetes drug candidate ID110521156 at its IR meeting on September 29, 2025. This drug holds significant promise as a future growth driver for the company.

Why Does it Matter? Ildong’s Current Challenges

Ildong is facing challenges with declining sales and continued net losses. While the development of its COVID-19 treatment, Xocova, is positive, the success of its new drug development will be crucial for the company’s turnaround.

What’s the Potential Impact? Positive vs. Negative Scenarios

- Positive Scenario: Positive Phase 1 results could lead to a rise in stock price and improved investor sentiment, increasing the likelihood of securing a long-term growth engine.

- Negative Scenario: Disappointing results could trigger a stock price decline and highlight weaknesses in existing business segments, potentially worsening the financial situation.

What Should Investors Do? Action Plan

- Before the IR Announcement: Review market expectations and Ildong’s financial status, and consider various potential scenarios.

- After the IR Announcement: Carefully analyze the announced results and consult expert opinions. Avoid impulsive decisions based on short-term volatility and adopt a long-term investment perspective.

Frequently Asked Questions

When will the Phase 1 results for ID110521156 be released?

They are scheduled to be announced at the company’s IR meeting on September 29, 2025.

Why are the Phase 1 results important?

They are a key indicator of Ildong’s ability to secure a future growth engine. Given the current financial difficulties, the success of the new drug development could be crucial for the company’s turnaround.

What should investors be aware of?

Investors should be mindful of potential stock price volatility before and after the announcement and adopt a long-term investment perspective. It’s crucial to carefully analyze the announced results and consult expert opinions. Additionally, factors like the competitive landscape of the obesity/diabetes treatment market and the likelihood of regulatory approval should be considered.