The upcoming HK inno.N Corporation IR event represents a pivotal moment for investors evaluating the company’s stock (KRX: 195940). As a major force in the healthcare and pharmaceutical sector, HK inno.N is preparing to host a crucial Investor Relations (IR) event in November 2025. This isn’t just a standard briefing; it’s a strategic platform designed to redefine the company’s growth narrative and recalibrate its corporate value in the eyes of the market. For those considering an HK inno.N investment, understanding the nuances of this event is paramount.

This comprehensive analysis explores the robust fundamentals underpinning HK inno.N’s market position, dissects the potential catalysts that could influence its stock price, and provides a clear roadmap for investors. We will delve into what to expect from the presentation and how the company’s vision could shape investor confidence and future valuation.

Event Details: The HK inno.N Corporation IR Briefing

HK inno.N Corporation has officially scheduled its Investor Relations (IR) event for November 17, 2025, at 9:00 AM. The primary objective is to foster a deeper understanding of the company’s strategic direction, operational performance, and long-term value proposition. The event will include detailed presentations on key business segments followed by an interactive Q&A session, offering a transparent look at the company’s current state and future ambitions. For verification, see the Official Disclosure (DART).

Unpacking HK inno.N’s Strong Fundamentals

Before analyzing the IR event’s potential impact, it’s essential to appreciate the solid foundation upon which HK inno.N is built. The company’s stability comes from its well-performing Ethical Drug (ETC) and Health & Beauty (H&B) divisions.

- •Impressive Financial Performance: As of Q3 2025, cumulative revenue reached KRW 771.3 billion with an operating profit of KRW 70.8 billion. This demonstrates consistent year-over-year growth, with the ETC division contributing a dominant 93% of total sales.

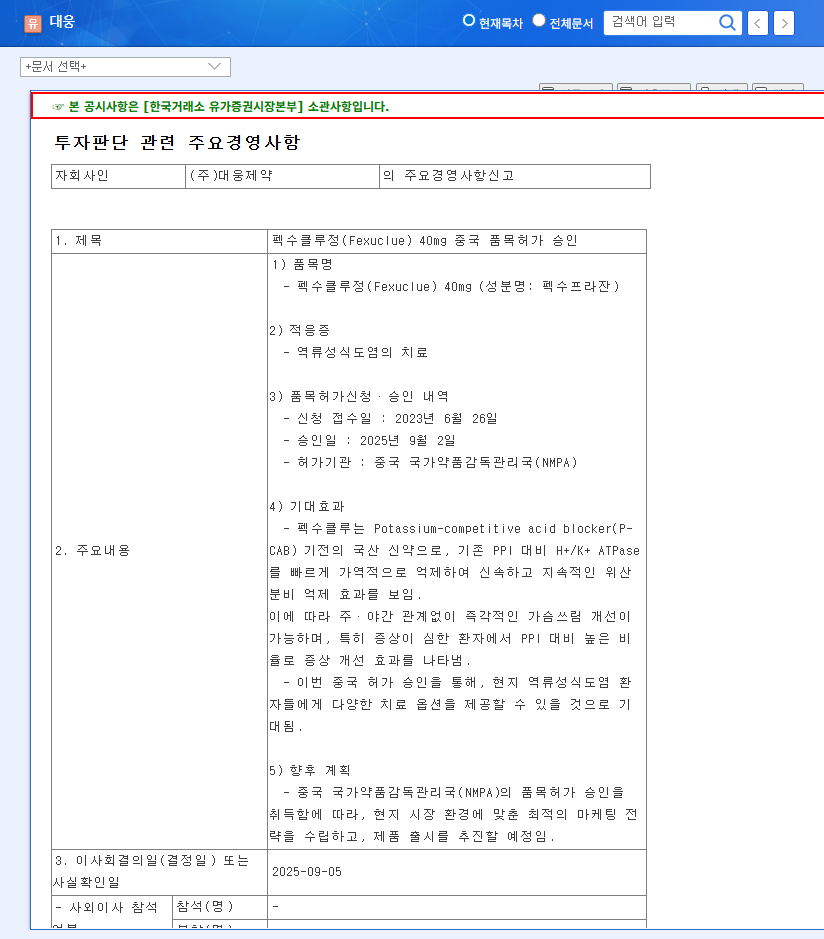

- •The K-CAB Powerhouse: K-CAB, the company’s blockbuster treatment for gastroesophageal reflux disease (GERD), not only dominates the domestic market but is also a cornerstone of the K-CAB global expansion strategy. Its growing international footprint is a significant future revenue stream.

- •Commitment to Innovation (R&D): HK inno.N allocates 7.93% of its sales to R&D, a clear signal of its dedication to future growth. The focus is on developing a robust pipeline of innovative drugs in high-demand areas like oncology, diabetes, and autoimmune diseases. You can learn more about pharmaceutical R&D trends from authoritative sources like major industry reports.

- •Stellar Financial Health: With a debt-to-equity ratio of just 55.24% (Q3 2025), the company boasts a remarkably stable financial structure. This low leverage empowers HK inno.N to aggressively fund R&D and strategic expansions without significant financial strain.

The core of any successful HK inno.N investment thesis lies in the dual engines of K-CAB’s global market penetration and the long-term potential of its diverse R&D pipeline.

Analyzing the IR Event’s Impact on the HK inno.N Stock Price

This IR event is a double-edged sword, with the potential to significantly sway the HK inno.N stock price. Investors should be prepared for both bullish and bearish scenarios.

The Bull Case: Potential Positive Catalysts

- •Clarified Growth Roadmap: A detailed and confident presentation on K-CAB’s entry into new markets (e.g., US, Europe) and positive clinical data from the R&D pipeline could dramatically increase investment appeal.

- •Enhanced Investor Trust: Transparent communication and satisfactory answers during the Q&A can resolve market uncertainties, building stronger confidence in the management team.

- •Upgraded Analyst Ratings: Positive surprises or a compelling long-term vision could lead to analyst upgrades, creating short-term buying pressure on the 195940 stock.

The Bear Case: Potential Negative Risks

- •Underwhelming Outlook: If the growth forecasts or pipeline updates fall short of market expectations, it could trigger a sell-off. Delays in K-CAB’s overseas launches are a key risk to monitor.

- •Vague or Insufficient Answers: Evasive responses to critical questions about competition, clinical trial risks, or market challenges could erode trust and be interpreted negatively.

- •Macroeconomic Headwinds: A failure to present a convincing strategy for navigating challenges like interest rate hikes or currency fluctuations could amplify investor concerns.

Actionable Insights for Investors

This HK inno.N Corporation IR event is a critical data point for your investment strategy. To make an informed decision, investors should focus on the substance behind the presentation. Pay close attention to concrete data, timelines, and the strategic rationale for their plans. Compare their projections with existing pharmaceutical market analyses to gauge their realism.

In conclusion, the event has the potential to be a significant value-unlocking catalyst. By clearly articulating its vision for K-CAB’s global dominance, the progress of its innovative drug pipeline, and its sound financial management, HK inno.N can solidify its position as a compelling long-term investment. We encourage investors to monitor the event closely and analyze the outcomes before making any portfolio adjustments.