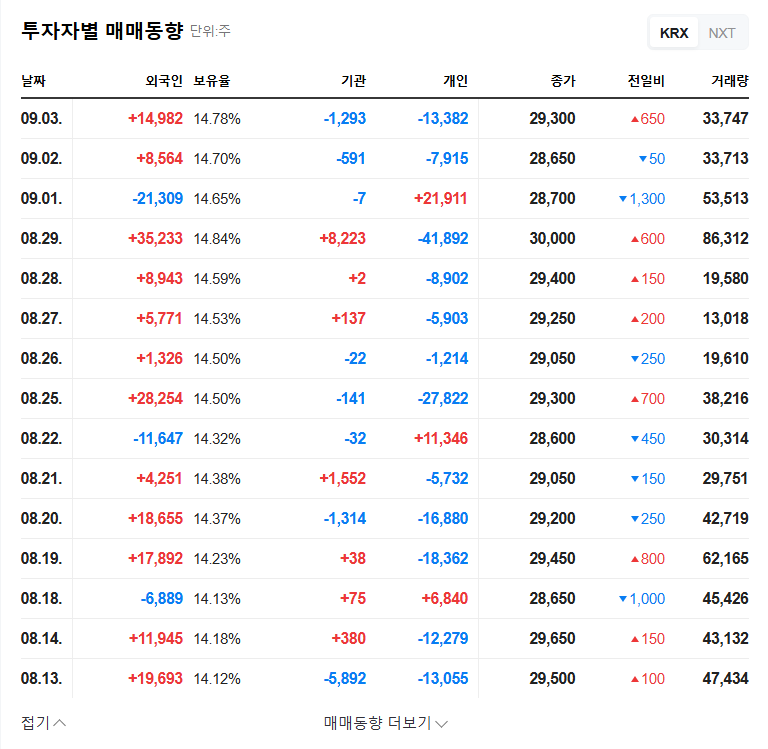

Investors in JAEYOUNG SOLUTEC CO.,LTD. (049630) are at a critical juncture. The company’s recent announcement regarding a large-scale JAEYOUNG SOLUTEC convertible bond exercise has sent ripples through the market. With millions of new shares on the horizon, stakeholders are asking crucial questions: Will this strengthen the company’s financial footing or lead to painful stock dilution? This comprehensive analysis will dissect the situation, providing a clear-eyed view of the company’s fundamentals, the market environment, and a prudent investment strategy to navigate the changes ahead.

The Core Event: The 2025 Convertible Bond Conversion

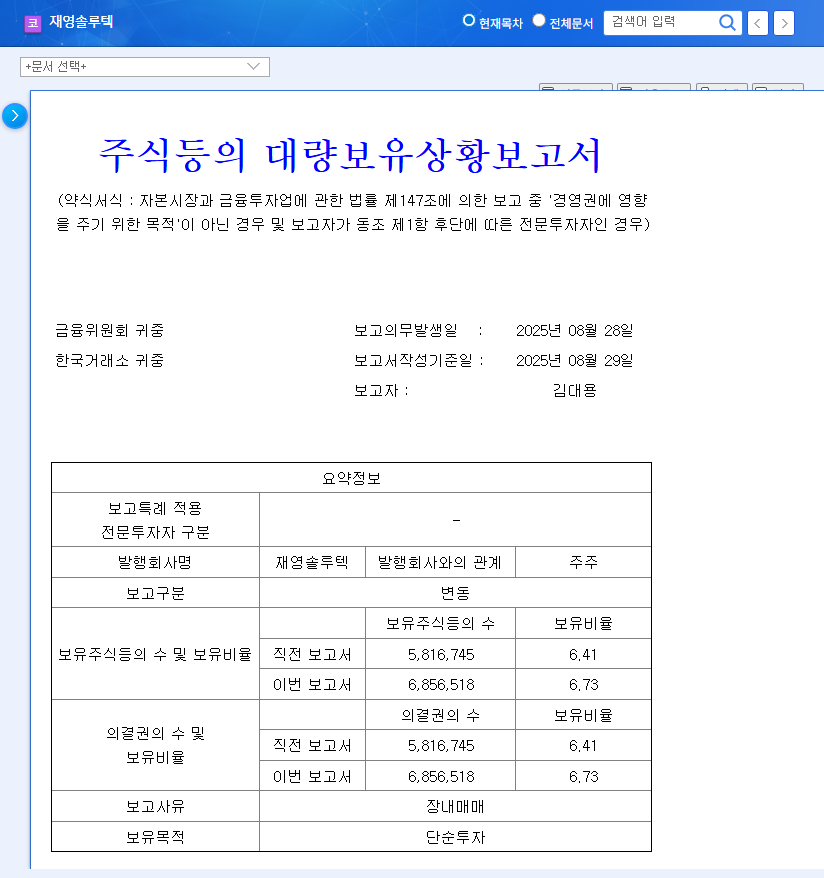

At the heart of the discussion is a major financial event. JAEYOUNG SOLUTEC has officially announced a significant exercise of its convertible bonds. For investors, understanding the precise details is the first step toward making an informed decision. This isn’t just a routine financial maneuver; it’s a move that will materially alter the company’s share structure.

Event Snapshot: JAEYOUNG SOLUTEC’s CB Conversion

• New Shares to be Listed: 7,552,870

• Scheduled Listing Date: November 26, 2025

• Conversion Price: 662 Korean Won (KRW) per share

• Market Impact: Represents 6.90% of current market capitalization.

• Source: Official Disclosure (DART)

Analyzing Financial Health: A Look at Q3 2025 Performance

To understand the context of the JAEYOUNG SOLUTEC convertible bond exercise, we must examine the company’s recent financial performance. The cumulative Q3 2025 results paint a mixed picture of growth in one area and pressure in another.

Revenue Growth vs. Profitability Decline

On the surface, a 30% year-on-year revenue increase looks robust, driven primarily by strong sales from the nano-optics division. However, this top-line growth did not translate to the bottom line. Operating profit saw a significant decrease, squeezed by rising costs of sales, higher administrative expenses, and inventory valuation losses. This signals a critical deterioration in profitability that investors cannot ignore.

Improved Financial Structure

A bright spot is the company’s balance sheet. The conversion of previous bonds and an increase in capital surplus boosted total equity by about 16%. Coupled with an aggressive strategy of repaying borrowings, this has led to a healthier debt-to-equity ratio of 154.03%. This is a key reason companies utilize convertible bonds—to clean up their financial structure without taking on more traditional debt.

Impact on JAEYOUNG SOLUTEC Stock (049630): A Double-Edged Sword

The upcoming JAEYOUNG SOLUTEC convertible bond listing presents both opportunities and risks for the stock price. Navigating this requires a balanced perspective.

The Upside: Potential Positives

- •Strengthened Balance Sheet: The conversion directly reduces debt and increases capital, enhancing financial stability and potentially making the company more attractive to long-term investors.

- •Increased Trading Liquidity: The influx of over 7.5 million new shares will increase the public float, which can lead to higher trading volumes and potentially more stable price action over time.

- •Short-Term Momentum: With the current stock price significantly higher than the 662 KRW conversion price, there is a strong incentive for bondholders to convert and sell for a profit, which can create complex but potentially positive trading dynamics.

The Downside: Potential Risks

- •Share Dilution: This is the most significant risk. The new shares dilute the ownership stake of existing shareholders, meaning each share now represents a smaller piece of the company. You can learn more about the effects of stock dilution on high-authority financial sites.

- •Selling Pressure: Bondholders converting at 662 KRW will be highly motivated to sell their new shares to realize profits, especially if the market price remains high. This wave of selling could put significant downward pressure on the stock price around the listing date.

- •Valuation Concerns: Given the weak Q3 profitability, the current stock price may already be considered high by some analysts. The addition of new shares could amplify these valuation concerns.

Investment Strategy & Outlook

Given these competing factors, a nuanced strategy is required. Blind optimism or pessimism is ill-advised.

Short-Term Approach (Pre- and Post-Listing)

In the immediate term, caution is paramount. The period surrounding the November 26, 2025 listing date will likely see heightened volatility. Aggressive buying is risky due to the potential for significant selling pressure from converting bondholders. A prudent strategy is to observe the market’s reaction and wait for the supply/demand imbalance to stabilize.

Mid- to Long-Term Approach

The long-term case for JAEYOUNG SOLUTEC stock rests on its core business fundamentals, particularly the growth and technological edge of its nano-optics division. For further reading, you might be interested in our deep dive into the nano-optics industry. The key catalyst for a positive long-term outlook will be a demonstrated improvement in profitability. Investors should closely monitor future earnings reports for a return to robust operating profit. The improved financial structure post-conversion is a solid foundation, but it must be followed by operational success.

In conclusion, the JAEYOUNG SOLUTEC convertible bond event is a defining moment. While it achieves the positive goal of deleveraging the company, the associated risks of dilution and short-term volatility demand a cautious and well-researched investment approach.