Satoshi Holdings & DigiP: What Happened?

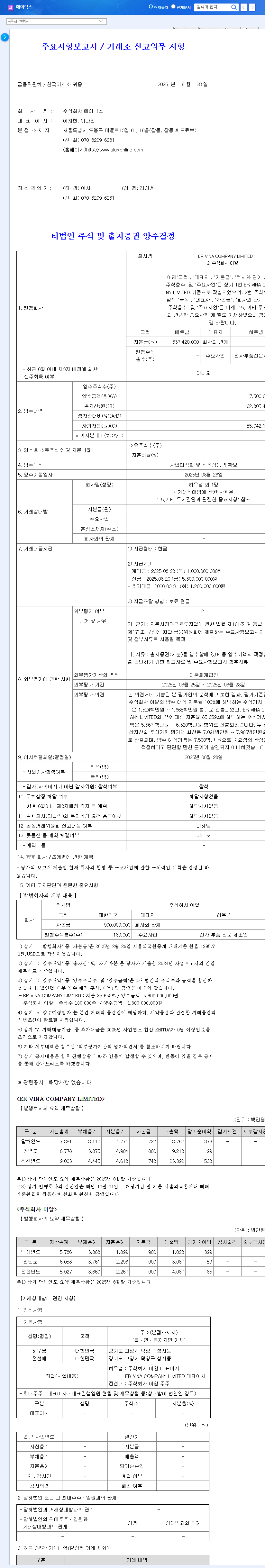

On September 19, 2025, Satoshi Holdings announced its acquisition of a 27.68% stake in DigiP for ₩10 billion. This will be achieved through a third-party allocation paid-in capital increase, with the acquisition date set for November 5, 2025. This effectively grants Satoshi Holdings management control of DigiP.

Acquisition Rationale: Why DigiP?

Satoshi Holdings operates in diverse sectors like e-commerce, beauty, and F&B, but has recently faced declining performance. The DigiP acquisition appears to be a strategic move to secure new growth engines and diversify its business portfolio, likely driven by the growth potential of the power infrastructure and renewable energy sectors.

Potential Impact: Opportunities & Risks

- Opportunities: Securing new growth drivers through entry into a new market, diversification of the business portfolio, and potential synergy with existing businesses.

- Risks: Potential failure to achieve synergy due to limited overlap with existing operations, increased financial burden and liquidity issues from the ₩10 billion outlay, exacerbation of existing financial risks due to high debt-to-equity ratio, and potential underperformance of DigiP.

Investor Action Plan: What to Do?

- Short-term Investors: Exercise caution due to uncertainties surrounding the acquisition and the financial risks involved. Continuously monitor related information and disclosures.

- Long-term Investors: Monitor the post-acquisition performance of DigiP, the synergy with Satoshi Holdings, and improvements in Satoshi Holdings’ financial structure over the long term.

Frequently Asked Questions (FAQ)

What kind of company is DigiP?

DigiP operates in the electrical business. However, the specific business model and financial status are unclear based on the current disclosures from Satoshi Holdings. Further information is needed.

How will this acquisition impact Satoshi Holdings?

Positively, it could lead to new growth drivers and business diversification. However, the ₩10 billion investment could increase financial burden, and there’s a risk of failing to achieve synergy with DigiP.

What should investors be aware of?

Investors should carefully consider DigiP’s detailed business and financial status, the post-acquisition synergy plan, and Satoshi Holdings’ funding plans and financial management strategies. Monitoring post-acquisition performance of DigiP and Satoshi Holdings’ financial health is crucial.