The latest developments surrounding HYUNDAI BIOSCIENCE’s CP-PCA07 have captured significant attention in the biopharmaceutical and investment communities. As the company advances its innovative prostate cancer treatment into a new stage of its Phase 1 clinical trial, investors are closely evaluating the potential impact on HYUNDAI BIOSCIENCE’s stock and long-term value. This comprehensive analysis breaks down the significance of this milestone, assesses the company’s fundamentals, and provides a strategic outlook for potential investors.

We will explore the science behind CP-PCA07, the financial health of HYUNDAI BIOSCIENCE, and the critical factors that could influence its journey from clinical trial to commercialization. Whether you are a current shareholder or considering an entry point, this guide offers the expert perspective needed to navigate this high-stakes opportunity.

Advancement in the Fight Against Prostate Cancer: The CP-PCA07 Trial

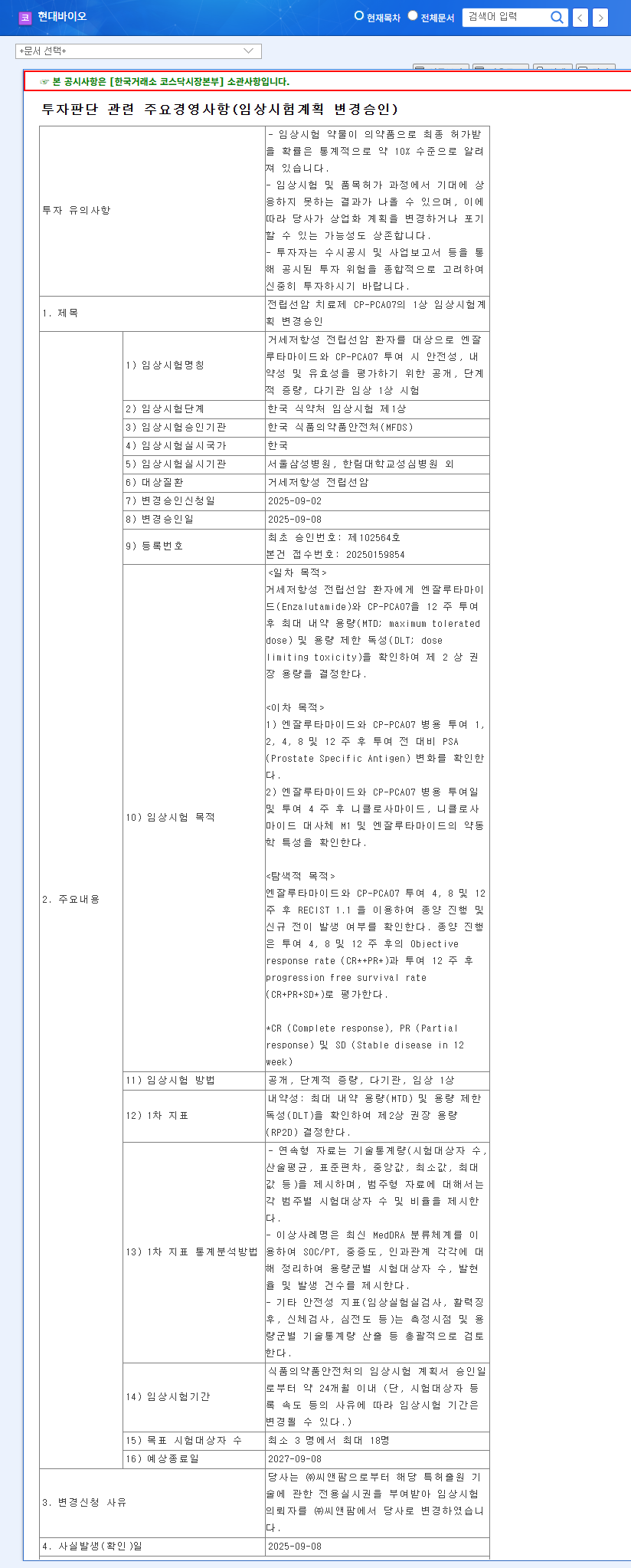

On October 13, 2025, HYUNDAI BIOSCIENCE CO., LTD. officially submitted an amendment application for its Phase 1 clinical trial protocol for CP-PCA07. This is not merely a procedural step; it marks a pivotal advancement in developing a treatment for Castration-Resistant Prostate Cancer (CRPC), a particularly challenging form of the disease. According to the National Cancer Institute, CRPC is cancer that continues to grow even when testosterone levels are reduced to very low levels. The official filing can be viewed here: Official Disclosure.

Key Objectives of the Amended Phase 1 Trial

The amended trial aims to evaluate the safety, tolerability, and efficacy of CP-PCA07 when used in combination with enzalutamide, a current standard-of-care treatment. This strategy is crucial as it explores a potential combination therapy that could significantly improve patient outcomes.

- •Primary Goal: To determine the Maximum Tolerated Dose (MTD) and identify any Dose-Limiting Toxicity (DLT), which will establish a safe and effective recommended dose for the larger Phase 2 trials.

- •Secondary Goal: To monitor changes in Prostate-Specific Antigen (PSA) levels, a key biomarker for prostate cancer, and analyze the drug’s pharmacokinetic characteristics (how it is absorbed, distributed, and metabolized by the body).

- •Exploratory Goal: To assess the drug’s impact on tumor progression and the potential for new metastasis.

The progression of a Phase 1 trial, especially with a combination therapy approach for a high-need area like CRPC, is a powerful signal of a company’s research and development maturity. Investors should view this as a de-risking event, albeit an early one.

Fundamental Analysis: HYUNDAI BIOSCIENCE’s Investment Profile

Beyond the promising news of the HYUNDAI BIOSCIENCE CP-PCA07 trial, a prudent investor must examine the company’s overall financial and operational health. For a comprehensive guide on this, consider reading our article on How to Analyze Biotech Stocks.

Strengths and Opportunities

- •Maturing R&D Pipeline: The progress of CP-PCA07 demonstrates tangible execution and builds confidence in the company’s broader drug development pipeline.

- •Strategic Partnerships: The exclusive license from affiliate CNPharm for formulation technology creates valuable synergy and protects intellectual property.

- •Revenue Diversification: A noted increase in revenue from ‘Other’ segments in the 2024 business report hints at successful new ventures like technology licensing, reducing reliance on a single product.

Risks and Considerations

- •Early-Stage Uncertainty: Phase 1 trials have a high rate of failure. Commercialization is still years away and requires navigating expensive and complex Phase 2 and 3 trials.

- •Financial Health: The company’s debt-to-equity ratio of 71.7% and persistent net losses (KRW 6,930 million) as of late 2024 require careful monitoring. Future clinical trials will demand significant capital.

- •R&D Investment Trends: A recent decrease in R&D expenditure as a percentage of revenue could be a red flag, as sustained investment is critical for long-term innovation in biotech.

Investor Takeaway: A Strategic Outlook

The advancement of the HYUNDAI BIOSCIENCE CP-PCA07 clinical trial is a significant positive catalyst. However, a balanced and cautious investment approach is paramount.

For short-term traders, the positive news flow may create momentum and volatility. Risk management is key, as any setback in the trial could reverse gains quickly.

For mid-to-long term investors, the focus should be on the forthcoming Phase 1 data. Positive results on safety and early efficacy signals would be a major validation. It is crucial to continuously monitor clinical trial progress, quarterly financial reports, and the company’s ability to fund its ambitious pipeline. While the risk is high, the successful commercialization of a novel prostate cancer treatment would fundamentally transform HYUNDAI BIOSCIENCE’s value proposition.

Frequently Asked Questions (FAQ)

What is HYUNDAI BIOSCIENCE’s CP-PCA07 Drug?

CP-PCA07 is an investigational drug developed by HYUNDAI BIOSCIENCE for the treatment of Castration-Resistant Prostate Cancer (CRPC). It is currently in a Phase 1 clinical trial to evaluate its safety and efficacy, particularly in combination with the existing drug enzalutamide.

What does the Phase 1 clinical trial amendment mean for the company?

This amendment represents concrete progress in the development of CP-PCA07. It refines the study’s goals and moves the drug forward in the clinical pathway, which can boost investor confidence and signals the company’s commitment to its oncology pipeline.

What are the main risks for investors in HYUNDAI BIOSCIENCE?

The primary risks are the high uncertainty of early-stage clinical trials, the company’s current financial status (including debt and net losses), and the substantial capital required for future R&D. Clinical trial failure would significantly impact the HYUNDAI BIOSCIENCE stock price.