In a landmark move for the renewable energy sector, Development Advance Solution Co., Ltd. (DASCO) has announced a staggering new DASCO hydrogen power contract that has sent ripples through the market. For a company recently battling deteriorating fundamentals and a sluggish construction market, this ₩317.1 billion deal with Korea Electric Power Corporation (KEPCO) represents more than just revenue—it’s a potential turning point. This massive, long-term commitment raises a critical question for investors: Is this the catalyst that will redefine DASCO’s future? This article provides a comprehensive analysis of the contract, DASCO’s financial health, and the strategic implications for your investment portfolio.

The Landmark ₩317.1 Billion Hydrogen Power Deal Explained

On November 14, 2025, Development Advance Solution Co., Ltd. (KOSDAQ: 058730) formally announced the signing of the ‘2025 General Hydrogen Power Electricity Trading Contract.’ This agreement, made with KEPCO and other key energy players, is a monumental step for the company. The core details, as outlined in the Official Disclosure on DART, are as follows:

- •Contract Value: A colossal ₩317.1 billion, which remarkably represents 101% of DASCO’s entire annual revenue from the previous year.

- •Project Scope: The contract covers electricity trading for the 9.68MW Busan Myeongji 3rd Phase Fuel Cell Power Plant, a significant project in the nation’s push for clean energy.

- •Contract Duration: An extensive long-term agreement spanning approximately 22 years and 3 months, from November 14, 2025, to January 31, 2048.

The sheer scale and long-term nature of this agreement provide a predictable and substantial revenue stream, something that has been desperately needed to stabilize the company’s financial outlook.

Context: Why This Deal is a Game-Changer for DASCO

To fully grasp the importance of this contract, one must understand the challenging environment DASCO was navigating. The period leading up to this deal was marked by significant financial headwinds and market uncertainty.

Deteriorating Financial Performance

The company’s Q3 2025 report painted a grim picture. Revenue had fallen by 19.3% year-over-year to ₩177.48 billion, while the operating loss widened to ₩47.08 billion. This slump was not isolated to one division; it was a systemic issue affecting their core businesses in building materials, SOC, steel, and even energy. The energy sector, in particular, was squeezed by shifting renewable energy policies and soaring raw material costs, while the construction downturn hammered the building materials segment.

Mounting Financial Health Concerns

These operational struggles directly impacted DASCO’s balance sheet. The debt-to-equity ratio climbed from 76.88% to 94.89%, a worrying trend driven by an increase in short-term borrowings. This, combined with macroeconomic pressures like global interest rate hikes and exchange rate volatility, put the company in a precarious position. The new DASCO hydrogen power contract, therefore, arrived at a pivotal moment, offering a powerful antidote to these financial ailments.

This isn’t just another contract; it’s a strategic pivot. A 22-year revenue stream equivalent to an entire year’s sales can fundamentally reshape a company’s financial foundation and long-term growth narrative.

Potential Impacts & Investor Outlook

This KEPCO deal has the potential to dramatically alter DASCO’s trajectory. However, prudent investors must weigh the significant opportunities against the inherent risks.

The Bull Case: A New Era of Growth

- •Stable Revenue Foundation: The most immediate benefit is a secure, long-term revenue base, drastically reducing earnings volatility and improving financial planning capabilities.

- •Energy Sector Leadership: This contract solidifies DASCO’s position in the high-growth hydrogen power market. The global push for clean energy, detailed by sources like the International Energy Agency (IEA), supports a strong long-term outlook for this sector.

- •Improved Financial Health: Consistent cash flow from the contract can be used to pay down debt, lower the debt-to-equity ratio, and strengthen the balance sheet over time.

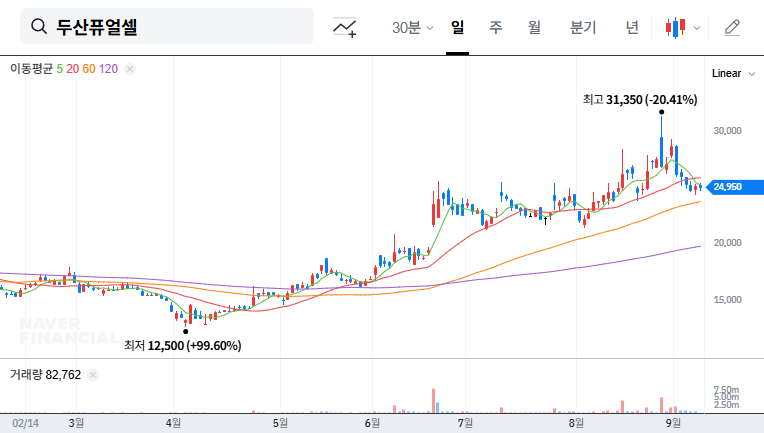

- •Positive Market Sentiment: A deal of this magnitude acts as a powerful signal to the market, boosting investor confidence and potentially driving the DASCO stock price upward.

Risks and Considerations to Monitor

While the outlook is promising, success is not guaranteed. Investors should keep a close eye on several factors:

- •Execution and Profitability: A long-term project is subject to unforeseen variables like inflation in raw material costs and operational challenges. DASCO’s ability to manage costs and maintain profitability margins will be critical.

- •Recovery of Core Businesses: The hydrogen deal is a massive boost, but the health of DASCO’s other divisions, especially building materials, remains crucial for overall corporate value. A full turnaround requires broad-based recovery.

- •Hydrogen Market Volatility: As an emerging industry, the hydrogen energy sector’s long-term trajectory depends on government policy, technological breakthroughs, and competitive dynamics.

Conclusion: A Prudent Investment Strategy

The ₩317.1 billion DASCO hydrogen power contract is unequivocally a positive and transformative event. It provides a powerful growth engine and a stable foundation to counteract the company’s recent struggles. For investors, this creates a compelling narrative that balances short-term momentum with long-term potential. While continued monitoring of operational execution and the recovery of legacy businesses is essential, this deal marks a new chapter for Development Advance Solution Co., Ltd. For those interested in understanding renewable energy investments, DASCO has just become a key case study to watch.