1. What Happened?

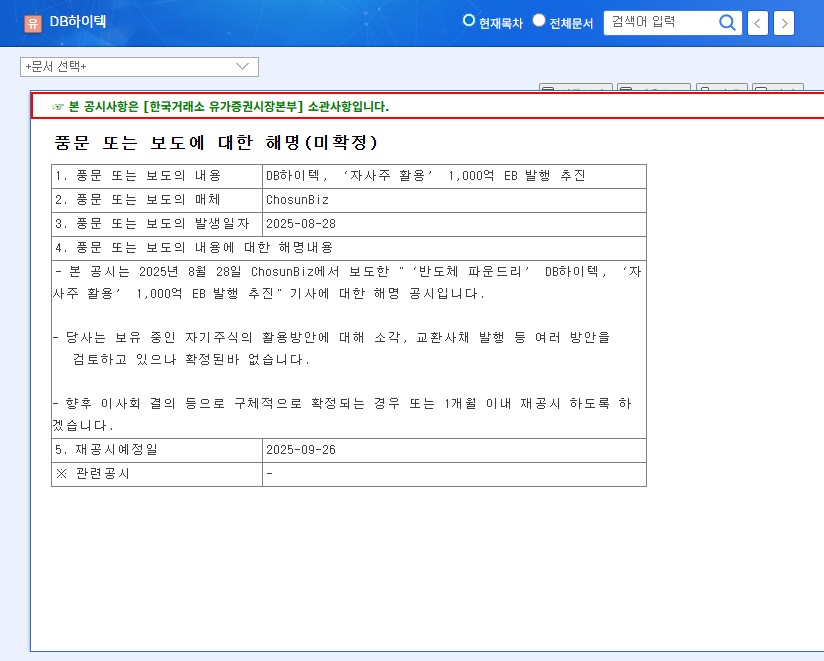

On September 24, 2025, news broke that Korea Land Trust is exploring the issuance of ₩50 billion in EBs. The company stated that this is being considered as part of a broader strategy to enhance shareholder value, potentially involving treasury stock, but that nothing has been finalized.

2. Why Issue EBs?

Korea Land Trust operates a diverse portfolio of businesses, including real estate trust, urban redevelopment, and REITs. The funds raised through the EB issuance are expected to be used for improving the company’s financial structure and securing investment resources for future growth. The link to potential treasury stock strategies also signals a commitment to enhancing shareholder value.

3. Opportunities and Risks of the EB Issuance

- Opportunities: Improved financial structure, secured investment resources, potential for increased shareholder value.

- Risks: Potential for share dilution (upon conversion), increased interest expense burden.

4. Macroeconomic Considerations

Current market conditions show increased volatility in interest rates, exchange rates, and the real estate market. This volatility could impact Korea Land Trust’s business and financial performance, and also influence the interest rate on the EBs.

5. What Should Investors Do?

- Confirm finalization and terms of the EB issuance (amount, interest rate, maturity, conversion terms, etc.).

- Analyze the impact of the EB issuance on the company’s financial structure and shareholder value.

- Monitor changes in macroeconomic indicators, such as interest rates, exchange rates, and real estate market trends.

- Continuously observe Korea Land Trust’s financial soundness and earnings performance.

FAQ

Has Korea Land Trust confirmed the EB issuance?

No, the issuance is currently under review and will be publicly announced upon confirmation.

How will the funds from the EB issuance be used?

The funds will be utilized to strengthen the company’s financial structure and secure investment resources for future growth. Treasury stock strategies are also under consideration.

How will the EB issuance affect the stock price?

While it could positively impact the company’s financials and shareholder value, there are risks, including potential share dilution and increased interest expenses.