1. What Happened?

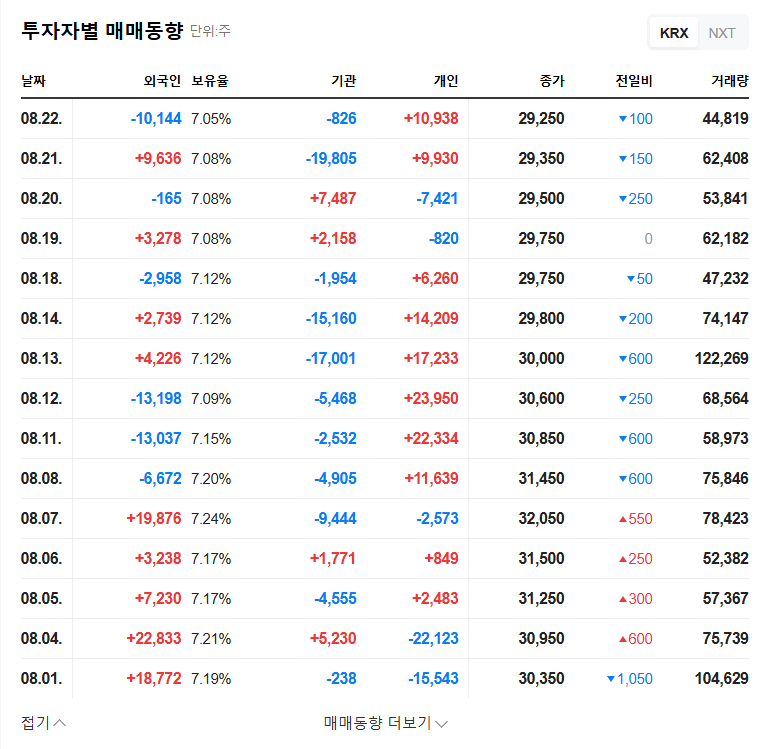

Adphorus listed on the KOSDAQ on August 26, 2025. However, the announced earnings (revenue of 8.9 billion KRW, operating profit of 1.2 billion KRW, and net profit of 0.9 billion KRW) fell short of investor expectations, leading to a stock price drop.

2. Why Did This Happen?

While the KOSDAQ listing was a positive event, the announced Q2 earnings differed significantly from the figures in the semi-annual report. This could be due to an error in earnings aggregation, but if accurate, the significant decrease in revenue and profit likely negatively impacted the stock price. Adphorus has experienced a declining revenue trend since 2023 and faces the risk of high revenue dependence on specific advertisers.

3. What’s Next?

Adphorus is expected to utilize the funds raised through the KOSDAQ listing for technology development and new business investments. The introduction of RTB technology and the partnership with Google are positive factors. However, reversing the declining revenue trend, diversifying the customer base, and achieving growth in new businesses will be key factors determining the company’s future value.

4. What Should Investors Do?

Investors might consider investing in Adphorus from a long-term perspective, considering its growth potential. However, it’s crucial to be cautious of short-term volatility related to the listing and earnings announcements. Carefully monitoring Adphorus’s future earnings reports and business strategies is essential for making informed investment decisions.

What is Adphorus’s main business?

Adphorus primarily operates an advertising platform business, managing the reward-based advertising platform ‘GreenP’ and the CubeMine platform. It has also ventured into e-commerce through a subsidiary.

How has Adphorus performed recently financially?

Adphorus recorded revenue of 17.262 billion KRW in the first half of 2025, showing a declining trend year-over-year. The Q2 earnings announced on August 26th differ from the semi-annual report and require verification.

What are the key risks to consider when investing in Adphorus?

Investors should consider the risks of declining revenue, high revenue dependence on specific advertisers, and increasing accounts receivable. Stock price volatility following the KOSDAQ listing should also be considered.