1. What Happened? Q2 2025 Earnings Breakdown

Phacell Bio reported revenue of -₩35 billion, operating profit of ₩6 billion, and a net loss of -₩19 billion for Q2 2025. While operating profit turned positive, revenue fell short of expectations, and the company continued to report a net loss.

- Revenue Decline Deepens: Revenue reached -₩35 billion, likely due to slower-than-expected uptake of its new product, ‘Goldmune,’ and ongoing challenges in commercializing existing pipelines.

- Surprise Operating Profit: Cost-cutting measures contributed to a ₩6 billion operating profit. However, its sustainability is questionable given the revenue decline.

- Net Loss Continues: Non-operating losses contributed to a -₩19 billion net loss, raising concerns among investors.

2. Why Did This Happen? Background and Analysis

The disappointing results are primarily attributed to delays in market penetration of new products and difficulties in commercializing existing pipelines. The highly competitive landscape of the anti-cancer immunotherapy market also likely played a role.

3. What’s Next? Outlook and Investment Strategy

While short-term downward pressure on the stock price is expected, the long-term outlook hinges on clinical trial results and potential licensing agreements for key pipelines. Investors should pay close attention to the following:

- Detailed Earnings Review: Understand the drivers behind the operating profit and the specifics of the revenue decline.

- Pipeline Development Monitoring: Track the progress of clinical trials and anticipated announcement dates to assess long-term growth potential.

- Macroeconomic Factors: Monitor the impact of fluctuations in interest rates and exchange rates on the company.

4. Investor Action Plan: Key Checkpoints

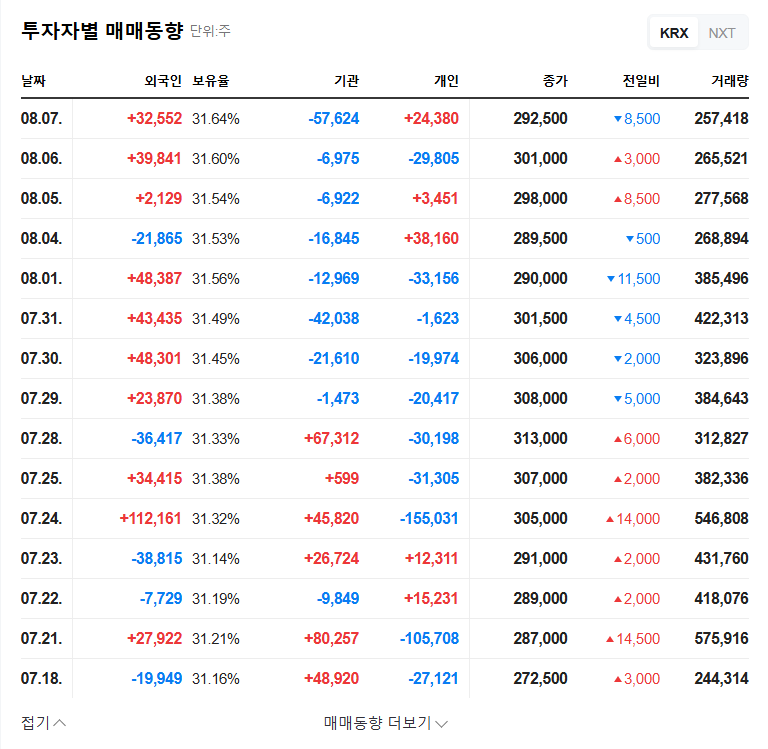

- Short-term investors should be aware of potential stock price volatility.

- Long-term investors should focus on pipeline development milestones and commercialization prospects.

- Continuously monitor further information releases and the company’s strategic responses.

Why are Phacell Bio’s Q2 earnings important?

These earnings provide crucial insights into the performance of Phacell Bio’s new ventures and its strategy for commercializing existing pipelines. While the positive operating profit is encouraging, the continued revenue decline raises concerns for investors.

What are Phacell Bio’s key pipelines?

Vax-NK, Vax-CARs, and Boxleukin-15 are the key pipelines. Clinical trials are underway for various cancers, including hepatocellular carcinoma, pancreatic cancer, and small cell lung cancer. The company has also entered the companion animal cancer immunotherapy market.

What should investors consider when evaluating Phacell Bio?

Investors should consider the inherent risks associated with pipeline development and the increasingly competitive market landscape. They should also be prepared for potential stock price volatility following the earnings announcement.