The latest DOOSAN ENERBILITY 2025 outlook has sent ripples through the investment community, signaling a significant shift in financial performance for the South Korean industrial giant (KRX: 034020). The company’s projection of a full-year shift to operating and net losses raises critical questions for current and potential investors. What are the underlying factors driving this downturn? How will this forecast impact DOOSAN ENERBILITY stock in the short and long term? This comprehensive analysis will delve into the official disclosures, dissect the market headwinds, and provide actionable investment strategies to navigate the challenges ahead.

The 2025 Forecast: A Shift into the Red

According to the company’s public filing, the Doosan Enerbility earnings forecast for the full year 2025 points to a stark reversal of fortune compared to the first half of the year. The official numbers, detailed in the Official Disclosure, are projected as follows:

- •Consolidated Revenue: KRW 469.4 billion

- •Operating Profit: KRW -30.8 billion (Shift to loss)

- •Net Profit: KRW -77.1 billion (Shift to loss)

This forecast confirms earlier warnings of a “significant decrease in sales in the Doosan Enerbility segment” and indicates a challenging second half of 2025, leading to an overall annual deficit. The market’s reaction will hinge on understanding the complex factors contributing to this downturn.

While the headline numbers are concerning, the underlying story is one of strategic investment amid macroeconomic pressure. The key for investors is to differentiate between cyclical downturns and long-term structural issues.

Unpacking the Headwinds: Factors Behind the Forecast

Several converging factors are contributing to the challenging DOOSAN ENERBILITY 2025 outlook. A thorough Doosan Enerbility analysis reveals both external market pressures and internal strategic decisions.

Macroeconomic and Market Pressures

- •Global Economic Slowdown: Persistent inflation and higher interest rates are dampening global demand. This directly impacts key business units like Doosan Bobcat, which is sensitive to volatility in the global construction market. For more context, see analysis from authoritative sources like Reuters on the global economy.

- •Supply Chain Volatility: Fluctuations in raw material prices, particularly steel and copper, combined with rising global logistics costs, are eroding profit margins on large-scale energy and construction projects.

- •Exchange Rate Fluctuations: As a major exporter and importer, Doosan Enerbility is exposed to currency risks. An unfavorable KRW/USD exchange rate can significantly impact both revenue reporting and import costs.

Internal Strategic Factors

- •Aggressive R&D Investment: The company is making substantial investments in future growth engines. While critical for long-term value, the high costs of developing SMRs, hydrogen fuel cells, and next-gen gas turbines exert significant short-term pressure on profitability.

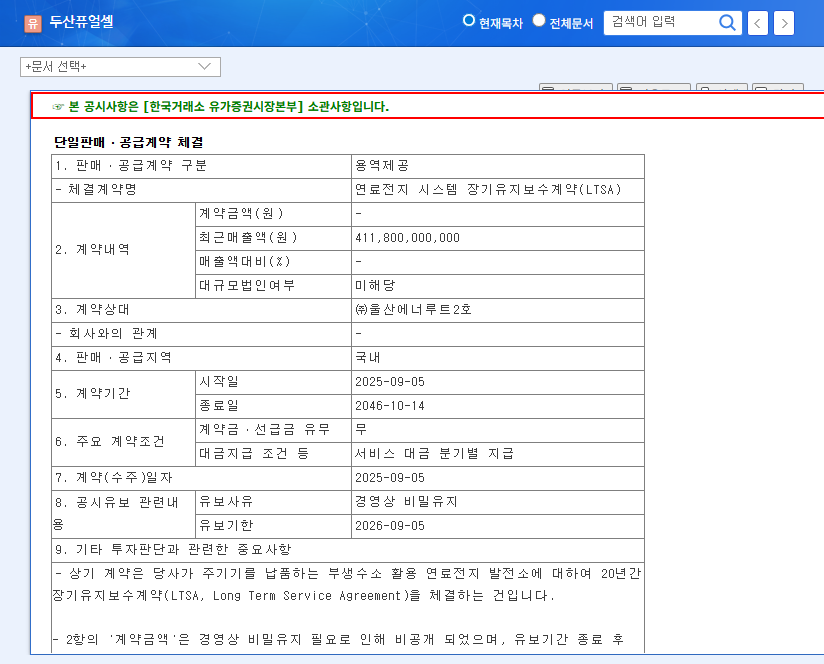

- •Doosan Fuel Cell Segment: This division continues to face profitability challenges due to intense market competition and evolving government policies in the renewable energy sector.

Impact on DOOSAN ENERBILITY Stock (034020)

The earnings revision is expected to have a dual-phased impact on the DOOSAN ENERBILITY stock price.

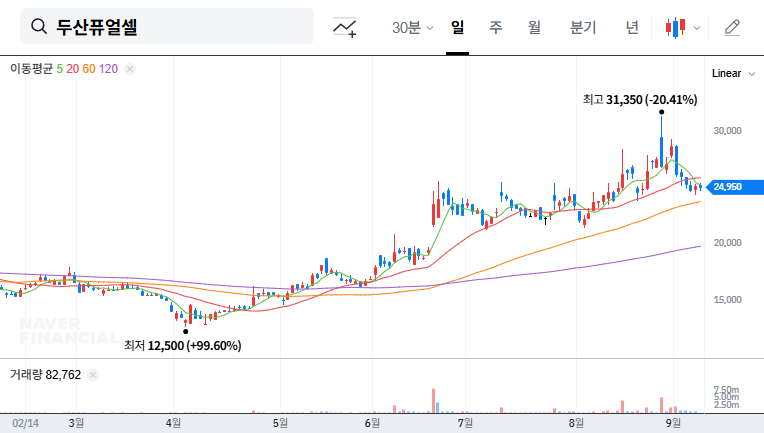

Short-Term Impact: In the immediate term, the market is likely to react negatively. The shift to a loss is well below prior consensus estimates, which will almost certainly trigger downward pressure on the stock price and a sharp deterioration in investor sentiment. A price correction is highly probable as the market digests this new information.

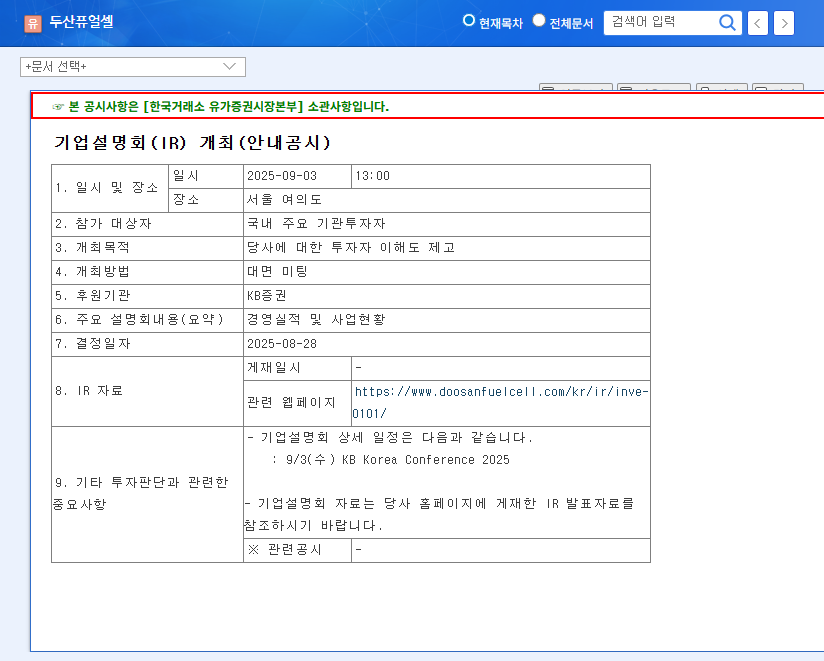

Mid-to-Long Term Impact: The long-term trajectory depends entirely on the company’s ability to convert its investments into tangible results. The market will be closely watching for key milestones, such as securing new contracts for Small Modular Reactors (SMRs), commercializing their hydrogen technology, or winning major gas turbine orders. Success in these areas could lead to a significant re-evaluation of the company’s worth, independent of the 2025 results.

Investment Strategy: Navigating the Volatility

Given the negative DOOSAN ENERBILITY 2025 outlook, investors should adopt a cautious and strategic approach tailored to their time horizon.

For the Short-Term Investor

A defensive stance is recommended. The risk of further downside is high following the announcement. It is prudent to wait for the stock price to stabilize and show signs of a bottom before considering entry. Monitor trading volumes and technical support levels closely.

For the Long-Term Investor

The short-term price dip could present a buying opportunity for those who believe in the company’s long-term vision. The focus should be on the fundamental value of its future growth engines:

- •Monitor Progress: Closely track the tangible outcomes from investments in nuclear, SMR, and hydrogen technologies. Look for press releases on new partnerships, orders, and technological milestones.

- •Diversification Value: Acknowledge the role of stable cash cows like Doosan Bobcat, which can provide a financial cushion during this transitional period.

- •Conservative Valuation: Evaluate the company’s potential for profitability improvement from a long-term, conservative perspective. Dollar-cost averaging on significant dips may be a viable strategy to build a position over time.

Disclaimer: These forecasts are projections and subject to change based on market conditions and company performance. Investors should conduct their own due diligence before making any investment decisions.