In a significant development for the South Korean construction sector, Dongbu Construction (005960) has officially announced a major contract win that has captured the attention of investors. The company has secured a ₩190.2 billion residential redevelopment project, a move that could signal a pivotal turn in its financial performance and market valuation. This deal, representing over 11% of its recent half-year revenue, raises a critical question: is this the catalyst needed to propel Dongbu Construction stock forward, or are there underlying risks that warrant a more cautious stance?

This comprehensive analysis delves into the specifics of the new Dongbu Construction contract, evaluates the company’s current financial health, and weighs the potential rewards against inherent market risks. We aim to provide investors with a clear, data-driven perspective on the future of Dongbu Construction.

Contract Details: A ₩190.2 Billion Urban Renewal Project

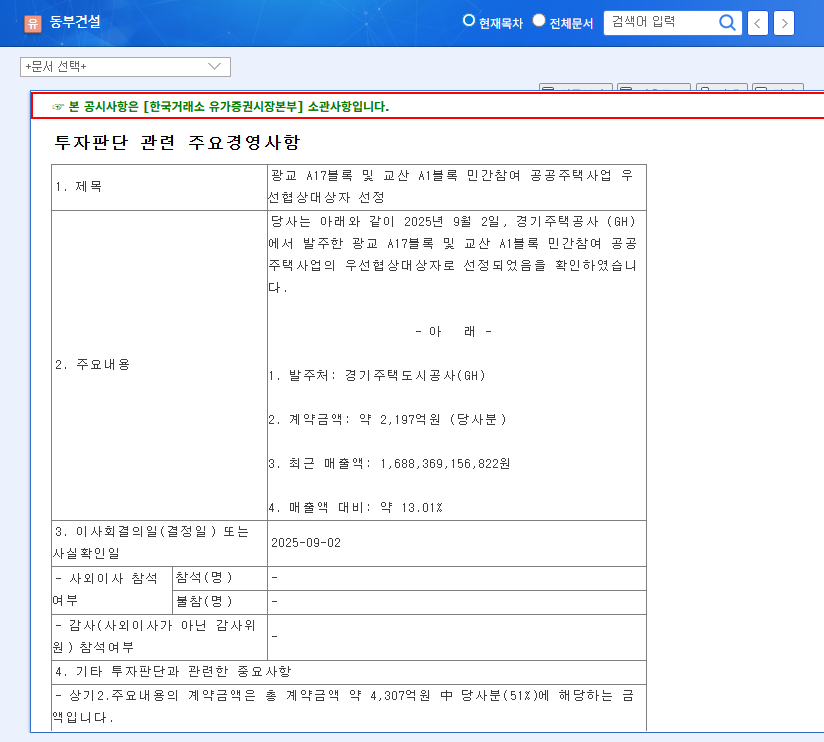

On October 1, 2025, Dongbu Construction disclosed the successful acquisition of the ‘Moa-Town’ residential redevelopment project located in the Siheung-dong area of Geumcheon-gu, Seoul. This is not just another project; its scale and strategic location make it a noteworthy achievement for the company.

- •Project Value: ₩190.2 billion

- •Company: Dongbu Construction (KRX: 005960)

- •Revenue Impact: 11.26% of H1 2025 revenue

- •Location: Siheung-dong 972, 973, 974 areas, Geumcheon-gu, Seoul

- •Source: Official Disclosure (DART)

The ‘Moa-Town’ initiative is a key part of Seoul’s urban planning strategy, focusing on improving low-rise residential areas. Securing such a project underscores Dongbu Construction’s competitive strength in the highly sought-after Seoul metropolitan market and reaffirms its capability to win large-scale, complex urban development contracts.

Analyzing Dongbu Construction’s Financial Health

This contract win doesn’t exist in a vacuum. It builds upon a foundation of improving fundamentals reported in the first half of 2025, painting a picture of a company on a potential upswing.

The Bull Case: Signs of a Turnaround

- •Return to Profitability: A net profit of ₩10.7 billion marks a significant turnaround from the previous year’s loss, signaling improved operational efficiency.

- •Massive Order Backlog: With an order backlog of ₩18.3983 trillion, the company has secured a stable and predictable revenue stream for the coming years. For more information on project pipelines, you can review our guide to construction industry metrics.

- •Strategic Diversification: Proactive expansion into renewable energy, overseas markets, and advanced plant projects showcases a commitment to long-term, sustainable growth beyond traditional construction.

This new ₩190.2 billion contract serves as a powerful validation of Dongbu Construction’s recovery narrative, directly bolstering its revenue pipeline and strengthening its market position in urban redevelopment.

The Bear Case: Potential Risks and Headwinds

Despite the positive news, prudent investors must consider the challenges. The construction industry is notoriously cyclical and sensitive to broader economic conditions. According to market analysis from sources like Bloomberg, macroeconomic factors remain a concern.

- •Macroeconomic Pressures: Persistent high interest rates and volatile raw material prices could squeeze profit margins, even with stable rebar costs.

- •Financial Leverage: A consolidated net debt-to-equity ratio of 64.29% is manageable but requires careful monitoring, especially in a high-interest environment.

- •Unbilled Construction: With ₩230.1 billion in unbilled construction, there is a risk to short-term cash flow if revenue recognition is delayed by project milestones.

- •Execution Risk: Large redevelopment projects are complex, with potential hurdles related to permits, design changes, and cost overruns that demand impeccable project management.

Investor Outlook & Action Plan

The recent Dongbu Construction contract is unequivocally positive news. It validates the company’s operational capabilities and aligns perfectly with its ongoing financial turnaround. This event should provide a solid floor for the Dongbu Construction stock price and improve investor sentiment.

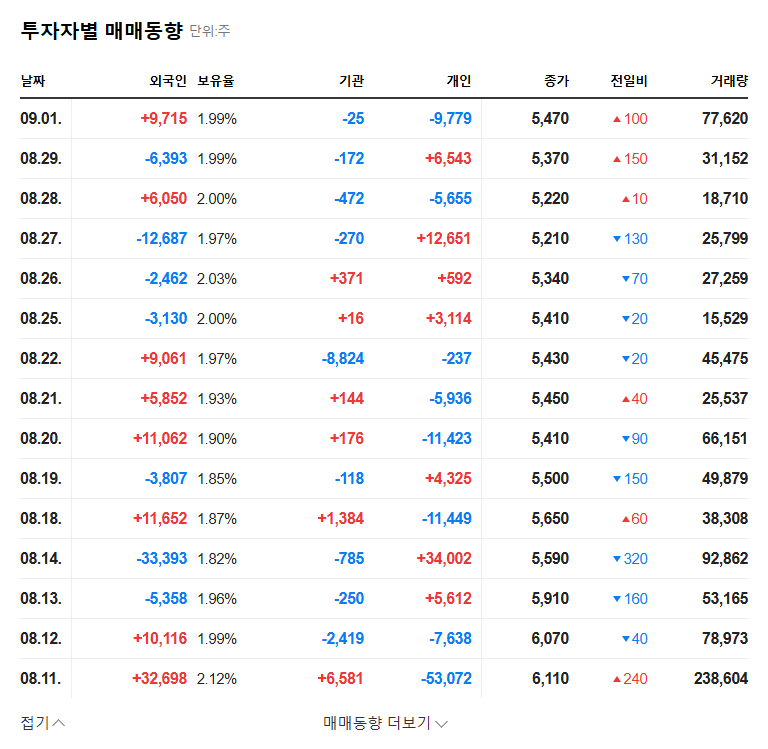

However, the stock’s performance in late 2024, hovering in the ₩4,000 range, suggests that the market may require more than a single contract win for a significant breakout. A sustained rally will likely depend on consistent execution, successful cost management on this new project, and a continued improvement in core financial metrics.

Therefore, a prudent ‘Hold’ strategy is recommended for existing investors. For new investors, this development warrants placing Dongbu Construction on a watchlist. Key performance indicators to monitor include quarterly earnings reports, progress on the Siheung-dong project, and any reduction in the company’s debt-to-equity ratio. A gradual accumulation strategy could be considered on any market dips, viewing it as a long-term recovery play.

Disclaimer: This article is for informational purposes only and should not be considered investment advice. All investment decisions should be made with the consultation of a qualified financial professional.