In a world increasingly driven by artificial intelligence, savvy investors are searching for companies poised to dominate the next technological frontier. This Suprema Inc. investment analysis delves into a key player in the high-growth sector of AI biometrics, offering a detailed look at a company shaping the future of security.

On November 5, 2025, Suprema Inc. (236200), a global leader in AI-powered biometric solutions, will host a pivotal Investor Relations (IR) session. This event is more than a standard corporate update; it’s a window into the company’s strategic vision and its roadmap for capitalizing on the booming demand for intelligent security systems. This analysis will equip you with the insights needed to interpret the IR event and understand the long-term potential of AI biometrics stocks.

Suprema Inc. (236200) IR Event: The Official Details

Suprema Inc. has scheduled its Investor Relations (IR) conference to provide a transparent overview of its current business operations, financial health, and future growth strategies. The primary goal is to enhance shareholder value by clearly communicating the company’s trajectory to investors. The session will include presentations on key business segments and a comprehensive Q&A session.

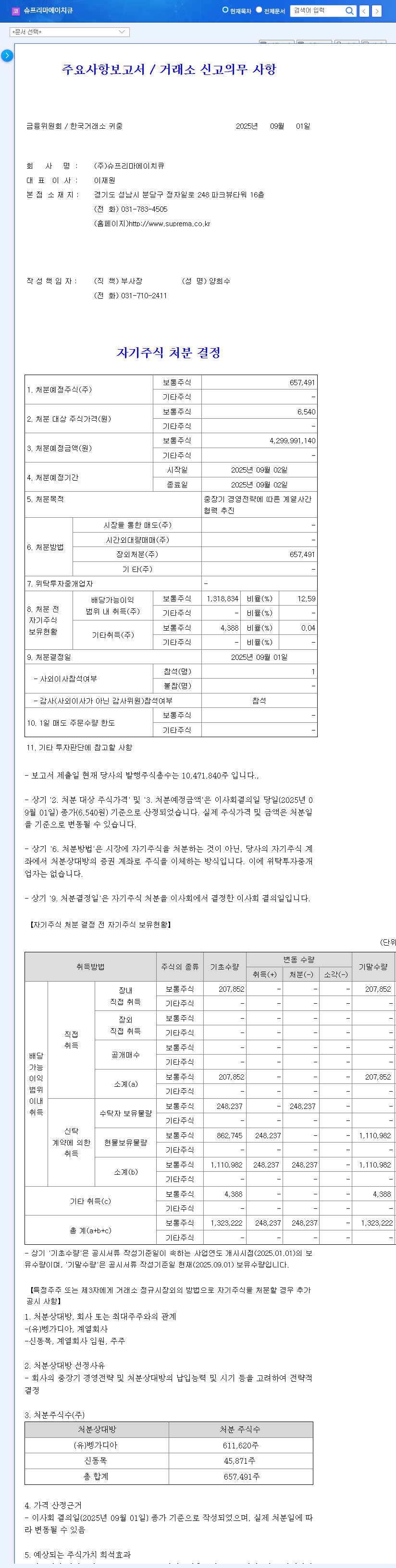

For complete, verified details regarding this event, please refer to the company’s official filing.

Official Disclosure: Click to view DART report.

In-Depth Suprema Inc. Investment Analysis

A thorough evaluation reveals a company with a strong foundation and significant growth vectors, balanced by macroeconomic and competitive risks. Understanding both sides is crucial for any potential investor.

The Bull Case: Why Suprema is a Leader in AI Biometrics

Suprema’s strength is built on several key pillars that position it for sustained growth in the security technology market.

Suprema Inc. is not just participating in the AI revolution; it’s actively leading the charge in the biometric security space, combining cutting-edge technology with a sound global strategy.

- •Technological Supremacy: Suprema’s competitive edge is its AI-driven product line. The CES 2025 Best Innovation Award and its AI-integrated control platform demonstrate a commitment to R&D that keeps it ahead of competitors. This translates to more accurate, faster, and secure solutions for customers.

- •Aggressive Global Expansion: By establishing direct subsidiaries in North American and European markets, Suprema is capturing more of the value chain. This strategy increases profit margins and provides direct customer feedback, fueling further innovation.

- •Rock-Solid Financials: A debt-to-equity ratio of just 7.8% is exceptionally low, indicating a financially conservative and stable company. This ‘fortress balance sheet’ allows Suprema to weather economic downturns and self-fund strategic R&D without relying on costly debt.

- •Diversified Revenue Streams: Growth is not limited to one area. Increased orders from domestic public procurement, coupled with the expansion of its smartphone fingerprint solutions via a licensing deal with Qualcomm, shows a well-diversified business model.

The Bear Case: Potential Risks and Headwinds

No investment is without risk. Investors should carefully consider the external and internal challenges facing Suprema.

- •Macroeconomic Sensitivity: As a global exporter, Suprema is exposed to currency fluctuations and potential slowdowns in global corporate spending. A sustained high-interest-rate environment could delay large-scale security upgrade projects by its clients.

- •Intense Competition: The biometrics market is fierce. Suprema faces pressure from low-cost manufacturers in the mid-range market and must continually innovate to compete with tech giants entering the security space. Staying ahead requires significant and ongoing R&D investment. For more on market dynamics, see this Gartner report on security trends.

- •Overseas Investment Risk: While strategic, increasing investments in overseas technology companies carry integration and execution risks that require careful management.

Investor Action Plan: What to Watch for at the IR

The upcoming IR is an opportunity to get clarity on key strategic points. Investors should pay close attention to management’s commentary on the following topics to inform their Suprema Inc. investment analysis:

- •Future Technology Roadmap: Look for specific details on the next generation of AI-powered products. What new markets or capabilities will their R&D unlock?

- •Global Sales Performance: Ask for concrete growth figures and future targets for the North American and European markets.

- •Macro-Risk Mitigation: How is the company hedging against currency volatility? What is their strategy if a global recession materializes?

- •Capital Allocation Plans: With a strong balance sheet, how does management plan to deploy capital? Will it be through dividends, share buybacks, or strategic acquisitions?

Understanding these factors is key to evaluating tech stocks effectively. Based on the company’s strong fundamentals and clear growth potential, a confident presentation at the IR could serve as a significant positive catalyst for the stock price. However, investors must weigh this against the broader economic environment.

Disclaimer: This report is for informational purposes only and is based on publicly available information. All investment decisions are the sole responsibility of the investor.