PANGRIM CO., LTD. has announced a significant strategic move: the PANGRIM tangible asset disposal of its Gumi-based property for a substantial ₩65.7 billion. This decision, prompted by the Gumi City Cultural Leading Industry Complex Development Project, is far more than a simple real estate transaction; it’s a pivotal moment that promises to reshape the company’s financial landscape and unlock capital for future growth initiatives. For investors and market watchers, the key question is how this massive influx of liquidity will impact the PANGRIM stock price and its long-term corporate value.

This comprehensive analysis will delve into the specifics of the deal, the underlying strategic rationale, and the potential ripple effects on PANGRIM’s financial health and market valuation.

Transaction at a Glance: The ₩65.7 Billion Deal

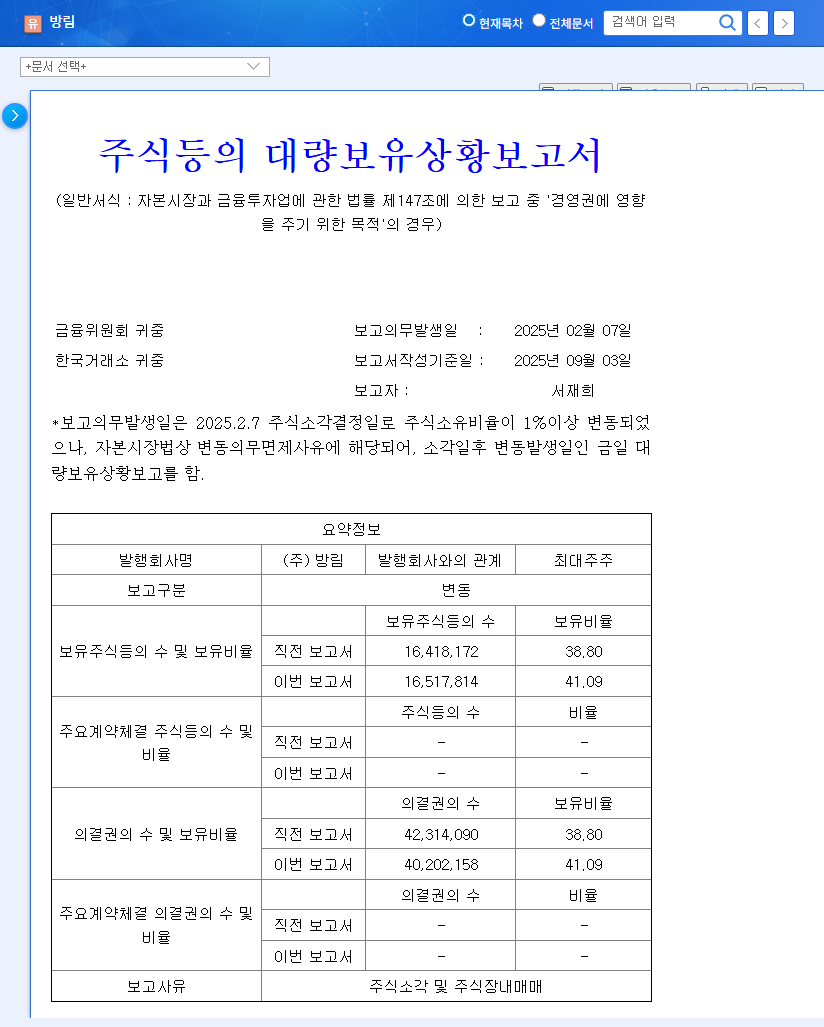

On November 3, 2025, PANGRIM formally announced the decision to transfer land and buildings in Gumi-si, Gyeongsangbuk-do. The official details of the transaction were confirmed in the company’s Official Disclosure (Source: DART). Here are the core components of this major financial event:

- •Disposal Amount: ₩65.7 billion, representing a significant 28.36% of the company’s total assets.

- •Assets Sold: Land and buildings located at 282, Gongdan-dong, Gumi-si, Gyeongsangbuk-do.

- •Counterparties: Gumi-si and Gumi Urban Development Corporation.

- •Expected Payment Date: September 30, 2026.

The Strategic Rationale Behind the PANGRIM Asset Sale

The primary driver for this PANGRIM asset sale is to cooperate with the Gumi City Cultural Leading Industry Complex Development Project. However, the benefits for PANGRIM extend far beyond simple compliance, representing a proactive strategy to optimize its balance sheet and prepare for future challenges.

Fortifying Financial Stability and Securing Liquidity

The infusion of ₩65.7 billion in cash is a game-changer for PANGRIM’s liquidity. In a high-interest-rate environment, as often discussed by global financial analysts, reducing debt is paramount. This capital allows the company to significantly pay down borrowings, which in turn reduces interest payment burdens and strengthens its overall financial soundness. An improved debt-to-equity ratio and stronger cash flow will provide a robust foundation for navigating economic uncertainties.

This asset monetization is a clear strategic step towards fortifying our financial stability and unlocking capital to reinvest in core growth areas, ensuring long-term value creation for our shareholders.

Optimizing Idle Assets for Future Investment

The Gumi property was identified as an underutilized or idle asset. This sale allows PANGRIM to convert a non-core, low-yield asset into highly flexible liquid capital. This capital can then be redeployed into high-growth opportunities, such as research and development, strategic acquisitions, or modernization of core production facilities, ultimately driving better returns on assets.

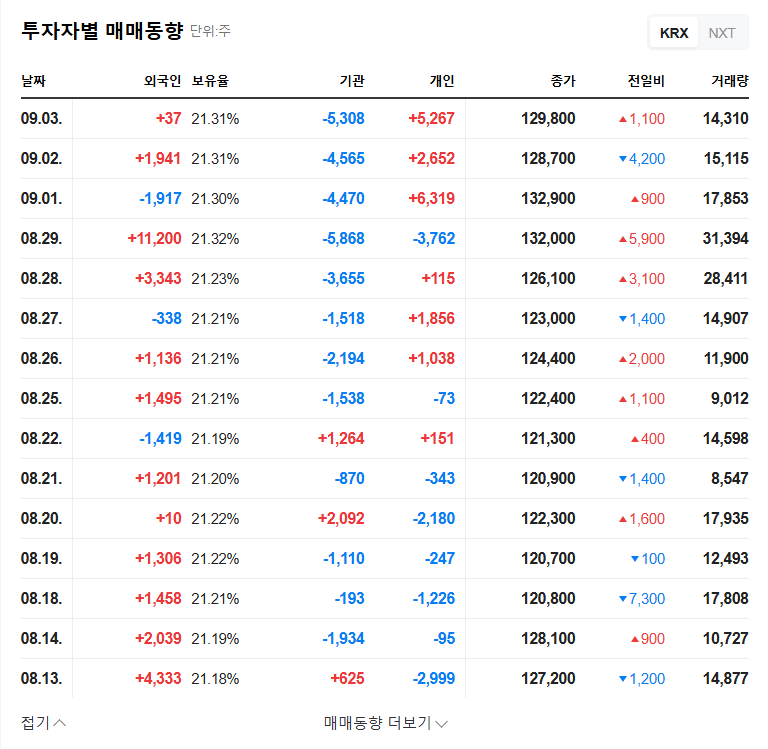

Impact on PANGRIM’s Stock Price and Investor Outlook

The market’s reaction to the PANGRIM tangible asset disposal will be a key indicator of investor confidence. Historically, PANGRIM’s stock has been trading in a tight range. This event has the potential to act as a major catalyst.

Potential for a Positive Re-rating

The significantly improved financial health and reduced risk profile could lead to a positive re-rating from investment analysts. The market often rewards companies that demonstrate prudent financial management and strategic foresight. The cash infusion could be a trigger for breaking out of its recent stock price channel, assuming the market perceives the long-term strategy favorably. For more context, you can review our previous PANGRIM quarterly report analysis.

Key Investor Considerations

While the news is overwhelmingly positive, savvy investors should monitor several key factors. The most critical is the company’s forthcoming plan for utilizing the ₩65.7 billion. A clear, strategic, and value-accretive plan will sustain positive momentum. Conversely, a lack of clarity could create uncertainty. Additionally, the reduction in the total asset base, while beneficial in this case, needs to be evaluated to ensure it does not impact long-term operational capacity.

Action Plan and Conclusion for Investors

PANGRIM’s decision is a highly positive strategic maneuver. It cleans up the balance sheet, provides a war chest for future growth, and de-risks the company in a volatile economic climate. Investors should consider the following actions:

- •Monitor Fund Utilization Plans: Watch for official announcements from PANGRIM on how the capital will be deployed. This will be the most significant driver of future value.

- •Assess Core Business Performance: Continue to monitor the performance of PANGRIM’s main business operations, as financial health is only one part of the investment thesis.

- •Evaluate Market Sentiment: Track analyst ratings and market sentiment following this announcement to gauge broader institutional perspectives.

In conclusion, the PANGRIM tangible asset disposal is a powerful and positive catalyst. While the immediate benefits to financial stability are clear, the long-term impact on the stock price will ultimately depend on the strategic execution of its newly acquired financial firepower.