1. What Happened? Decoding the After-Hours Block Deal

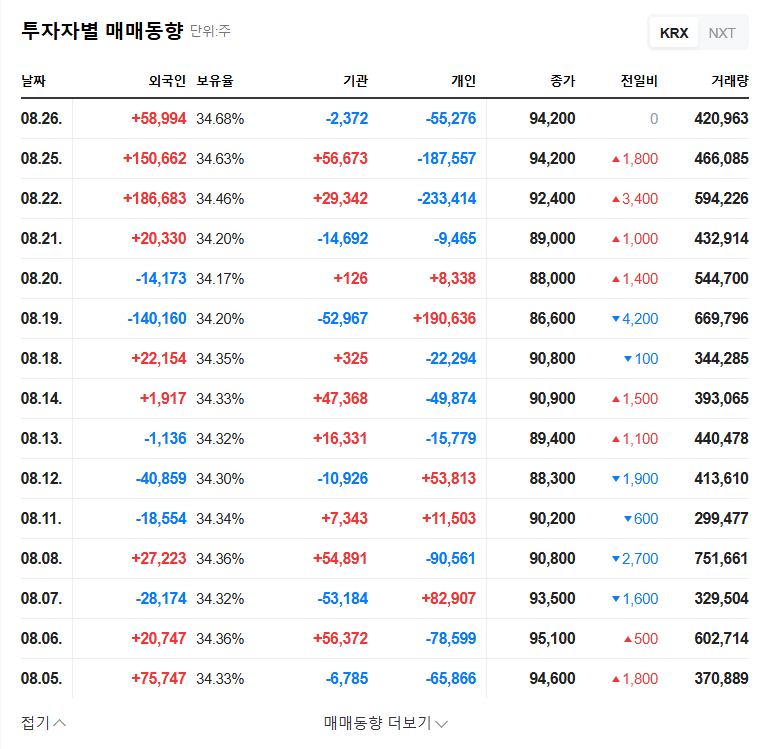

On September 5, 2025, 12,272 shares of Hanwha Aerospace were traded for ₩11.3 billion in an after-hours block deal. The active participation of foreign investors in both buying and selling is notable, potentially impacting short-term stock price volatility.

2. Why? Fundamental Analysis and Outlook

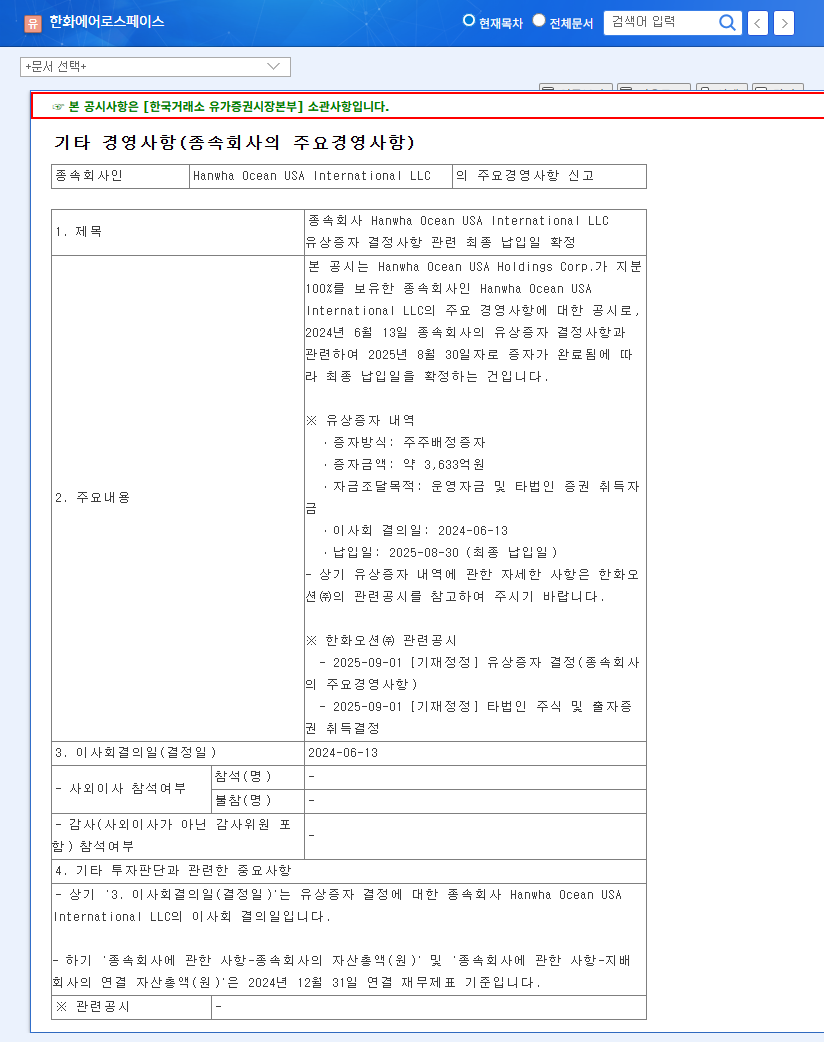

Hanwha Aerospace has achieved substantial growth through the integration of its marine business (Hanwha Ocean) and maintains a strong performance in the defense sector. However, initial investment burdens in the aviation business and foreign exchange risks should be considered.

- Positive Factors: Strong performance in marine/defense sectors, continuous R&D investment

- Negative Factors: Initial investment burden in the aviation sector, exchange rate volatility

While the block deal doesn’t directly impact fundamentals, foreign investor trends can be a crucial indicator of future stock price movements.

3. What’s the Strategy? Investment Approach

In the short term, monitor foreign investor trends and manage volatility. A long-term approach requires careful consideration of core business growth, new business performance, and overall market conditions.

- Short-Term Strategy: Monitor foreign investor trends, manage volatility.

- Long-Term Strategy: Analyze core business performance and new business development.

4. Key Monitoring Points for Investors

- Marine sector orders and profitability

- Defense sector exports and new contracts

- New business performance and market response

- Financial soundness indicators

- Macroeconomic factors such as exchange rates and oil prices

How does an after-hours block deal affect stock prices?

After-hours block deals can increase short-term stock price volatility, but they rarely directly impact a company’s fundamental value.

What are Hanwha Aerospace’s main businesses?

Hanwha Aerospace focuses on marine, defense, and aviation businesses, recently strengthening its marine business through the acquisition of Hanwha Ocean.

What should investors consider when investing in Hanwha Aerospace?

Investors should consider the initial investment costs of the aviation business, exchange rate volatility, and intensifying competition. It’s crucial to monitor the growth of core businesses and the progress of new businesses from a long-term perspective.