As a titan in the global K-beauty and home beauty device market, APR Co., Ltd. is approaching a pivotal moment. The upcoming APR Co Ltd Q3 2025 earnings presentation is more than just a financial update; it’s a critical litmus test for the company’s sustained growth momentum. Investors and market analysts are on high alert, eager to dissect the results and glean insights into the future of this innovative powerhouse. This comprehensive APR stock analysis will explore the company’s robust fundamentals, prevailing market trends, and a strategic investment outlook to help you navigate the potential outcomes of this significant event.

Event Horizon: The APR Co Ltd Q3 2025 Earnings Call

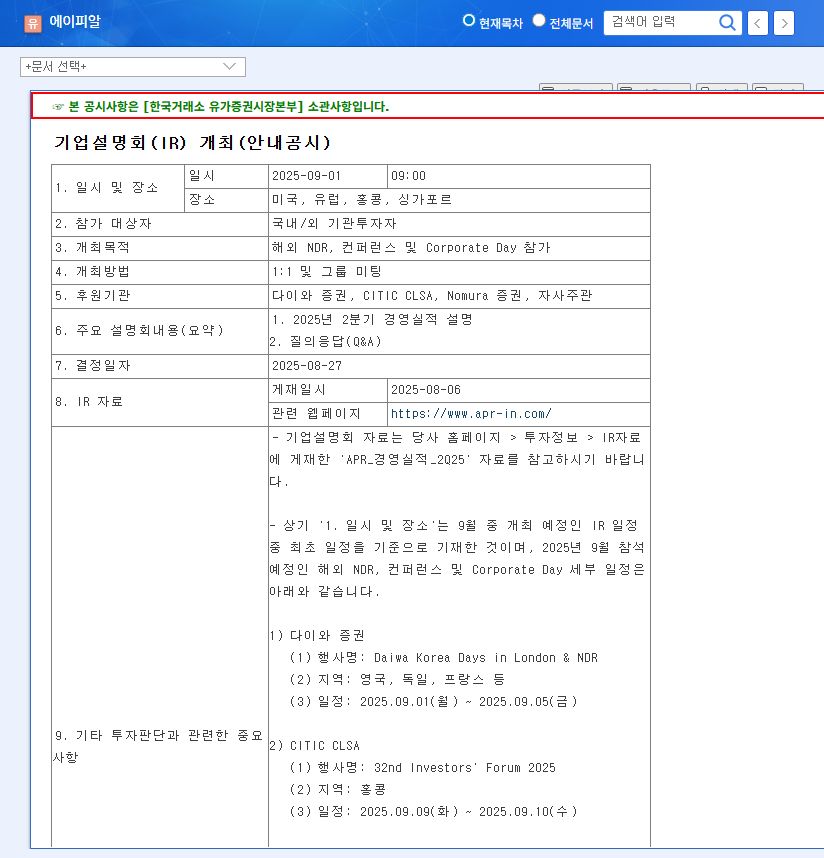

Mark your calendars. This upcoming earnings call is where APR will lay out its performance for the third quarter and provide crucial forward-looking guidance. The session will offer a direct line to management’s thinking, making it an indispensable event for anyone with a stake in the company.

- •Company: APR Co., Ltd. (Stock Code: 278470)

- •Event: Investor Relations (IR) for Q3 2025 Earnings Release

- •Date: November 6, 2025 (Wednesday)

- •Time: 10:00 AM KST

- •Source: For complete transparency, the official filing can be viewed here: Official Disclosure

Deconstructing the Growth Engine: A Look at APR’s Fundamentals

APR’s success isn’t accidental. It’s built on a dual-engine strategy of pioneering home beauty devices and cultivating globally beloved cosmetic brands. The semi-annual report for 2025 already painted a picture of potent growth, which sets high expectations for the Q3 results.

The Power of Innovation: Home Beauty Devices

The beauty device segment, spearheaded by breakout products like the ‘Booster Pro’, has been a phenomenal success. This division saw an impressive 30.5% growth rate, highlighting the strong consumer appetite for at-home, professional-grade beauty treatments. This performance solidifies APR’s position as a leader in the fast-growing home beauty device market.

Cultivating a Global Following: The Cosmetics Powerhouse

Complementing its hardware, APR’s cosmetics portfolio—featuring brands like ‘Medicube’, ‘Aprilskin’, and ‘Forment’—has seen explosive expansion. This segment achieved a staggering 66.0% growth rate, demonstrating its powerful brand equity and effective global marketing. This success is a key reason why many consider APR a top-tier investment among K-beauty stocks.

APR’s dual-engine growth in high-tech beauty devices and globally recognized cosmetics presents a compelling narrative. However, a sound APR investment strategy must weigh this against margin pressures and inventory management challenges revealed in the financials.

Financial Health Check: Profitability & Stability

While operating profit grew by 13.4%, the operating margin saw a slight contraction to 15.0% from 19.2% the previous year, primarily due to increased selling and administrative expenses. On a positive note, the company’s financial footing has strengthened, with the debt-to-equity ratio improving to a healthy 59.38%. A point of caution for investors is the notable increase in inventory, which will require efficient management to avoid future write-downs.

Riding the Wave: Market Trends Fueling APR’s Trajectory

APR’s growth is supported by powerful macroeconomic tailwinds. The global beauty market is undergoing a significant transformation, and APR is perfectly positioned to capitalize on it. According to market research from firms like Grand View Research, the demand for at-home aesthetic solutions is surging worldwide.

Since its listing in 2024, APR’s stock has maintained a steady upward trajectory, reflecting strong investor confidence. However, with a high proportion of overseas sales, the company’s profitability remains sensitive to exchange rate fluctuations (USD/KRW, EUR/KRW) and broader macroeconomic factors like interest rates and supply chain costs.

Investment Strategy: Potential Scenarios for APR’s Stock

The APR Co Ltd Q3 2025 earnings report will likely trigger one of two primary scenarios for the stock price.

The Bull Case: Catalysts for a Price Surge

If APR delivers Q3 results that exceed market expectations, particularly with continued strength in its core segments and an improvement in operating margins, it could serve as a powerful catalyst. Further positive momentum could come from concrete announcements on new business ventures (medical devices, home electronics), R&D breakthroughs, and a proactive shareholder return policy.

The Bear Case: Potential Risks and Headwinds

Conversely, a miss on revenue or earnings could trigger a sell-off. Key concerns would be any signs of a growth slowdown, failure to manage the rising inventory levels, or further margin compression. Mentions of intensified competition in the home beauty device space or a negative outlook on macroeconomic conditions during the Q&A could also dampen investor sentiment.

Your Action Plan: How to Approach the APR Investment

A prudent APR investment strategy requires careful monitoring and analysis. Here are key action points for investors leading up to and following the Q3 IR:

- •Analyze the Numbers: Scrutinize the Q3 report for revenue growth by segment, operating profit margin trends, and, crucially, the status of inventory management.

- •Listen to the Vision: Pay close attention to management’s commentary on future growth strategies, R&D pipelines, and plans for global expansion. Are the plans concrete and actionable?

- •Benchmark Against Consensus: After the IR, compare the results and guidance against market expectations to gauge the likely direction of investor sentiment.

- •Assess Risk Management: Evaluate the company’s stated strategies for mitigating risks related to competition, expense control, and macroeconomic volatility. For more context, review our guide to investing in the K-beauty sector.

Frequently Asked Questions (FAQ)

Q1: What are APR Co., Ltd.’s main business segments?

APR Co., Ltd. operates primarily in two high-growth areas: advanced home beauty devices (like the popular Booster Pro) and a successful portfolio of cosmetics brands (including Medicube, Aprilskin, and Forment).

Q2: What should I watch for in the APR Co Ltd Q3 2025 earnings call?

Investors should focus on top-line revenue growth, operating margin performance, inventory levels, and management’s guidance for Q4 and beyond. Any specific updates on new product launches or market expansions will also be critical.

Q3: What are the biggest risks to my APR investment strategy?

The primary risks include a potential slowdown in consumer spending, increased competition in the beauty tech space, margin pressure from rising costs, and adverse fluctuations in foreign exchange rates due to the company’s significant international sales.