What Happened? MOT’s KRW 210 Billion Contract

On September 2, 2025, MOT announced a KRW 210 billion contract to supply secondary battery assembly equipment. The contract period is for two years and one month, from September 1, 2025, to September 30, 2027. This contract is expected to be a significant turning point for MOT, which has recently recorded sluggish performance.

Why is it Important? A Chance for Performance Rebound

This contract is expected to have a substantial impact on MOT’s performance in the second half of 2025 and throughout 2026. In particular, its significant size, representing 24.75% of revenue, raises hopes for short-term performance improvement. It also presents a positive opportunity for MOT to diversify its customer base, given its previous dependence on a major client.

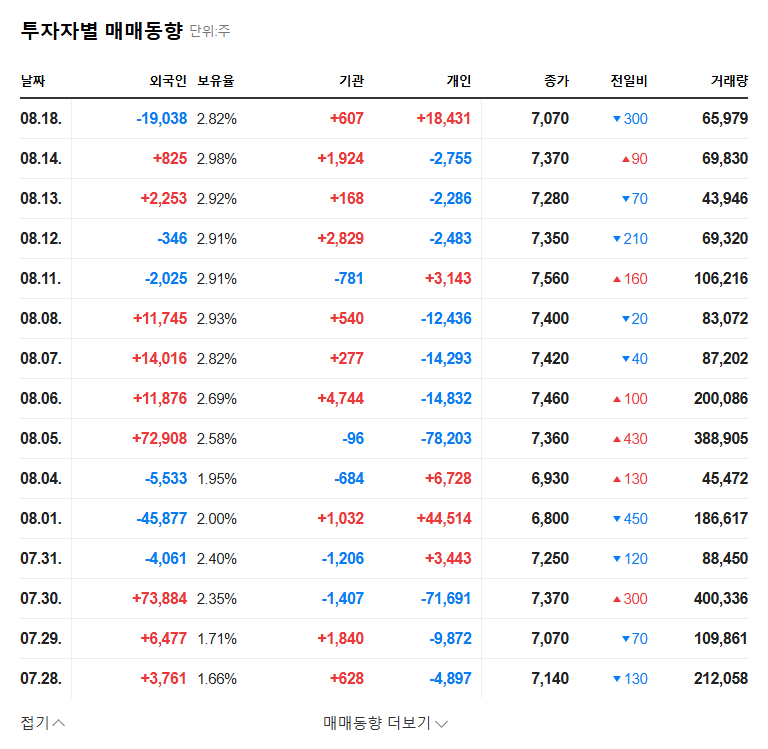

What’s Next? Stock Outlook and Investment Strategy

There is a high possibility of a short-term stock price increase, and if trading volume increases along with it, the upward momentum could be further strengthened. However, risk factors such as MOT’s financial soundness and global market uncertainties remain. Investors should carefully monitor the contract’s counterparty, terms, visibility of performance improvement, possibility of additional orders, and changes in the external environment.

Investor Action Plan

- Check Contract Counterparty and Terms: Verify whether it’s a new client and how the contract terms affect MOT’s financials.

- Track Performance Improvement Visibility: Continuously monitor the timing and scale of revenue recognition and the impact on operating profit.

- Monitor Additional Order Trends: Pay attention to the progress of the order pipeline and the possibility of further large-scale orders.

- Watch Macroeconomic and Industry Trends: Monitor external factors like the electric vehicle market, policy changes, and raw material prices.

Frequently Asked Questions (FAQ)

How will this contract impact MOT’s stock price?

A short-term price increase can be expected, but the long-term impact will depend on contract execution and performance improvement.

Who are MOT’s main customers?

MOT is highly dependent on ‘S Company,’ which accounts for approximately 77.94% of its sales.

What is MOT’s financial status?

As of the first half of 2025, MOT is experiencing an operating loss and deteriorating cash flow. While this contract is expected to improve the financial structure, continuous monitoring is necessary.

What are the future business prospects for MOT?

There is potential for business expansion along with the growth of the global electric vehicle market, but uncertainties such as market volatility and intensified competition also exist.