The shipbuilding world is abuzz with reports of a massive potential deal for HD Hyundai Heavy Industries (HD HHI), centered on a new fleet of cutting-edge, eco-friendly container ship orders. While the official contract remains unconfirmed, the news has ignited a firestorm of speculation among investors and industry analysts. This single event could redefine HD HHI’s growth trajectory, but with great opportunity comes significant uncertainty. This comprehensive analysis will unpack the situation, explore the broader market trends, and provide a strategic playbook for investors navigating the waters ahead of the scheduled re-disclosure date of November 14, 2025.

While the contract is not yet finalized, the potential order for eco-friendly container ships represents a pivotal moment for HD Hyundai Heavy Industries, aligning the company with the future of green shipping and promising a significant boost to its order backlog.

The Current Situation: What We Know

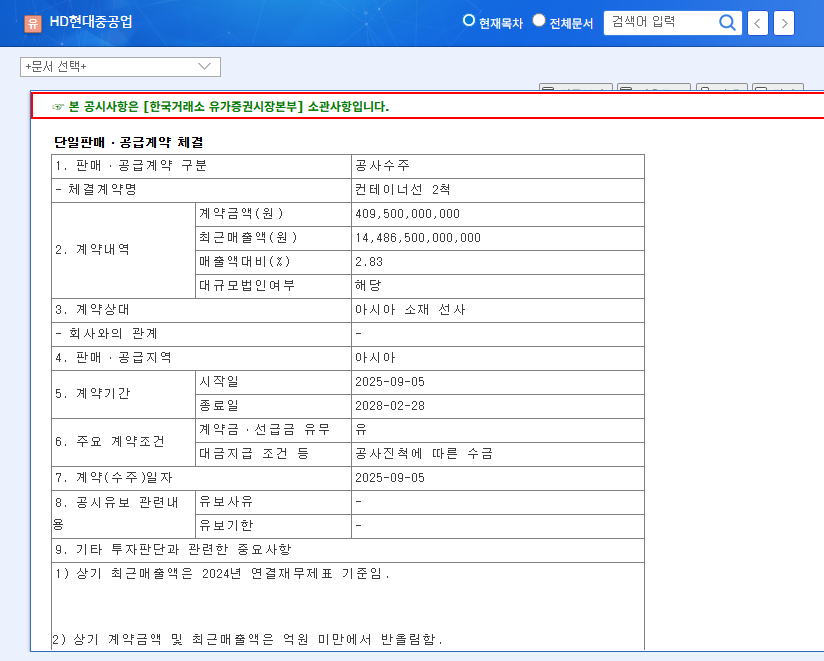

HD Hyundai Heavy Industries has officially addressed the market rumors, confirming that negotiations are actively underway but a final agreement has not been reached. The company has committed to a re-disclosure upon confirmation, setting a deadline of November 14, 2025. This lengthy timeline suggests a complex, high-value deal with numerous details to be ironed out. Investors must therefore balance the potential upside with the inherent risk of the deal falling through. The official statement can be tracked via the Official Disclosure (DART report).

Why Eco-Friendly Container Ship Orders are a Game-Changer

This isn’t just another large order. The focus on ‘eco-friendly’ vessels places HD Hyundai Heavy Industries at the forefront of one of the most significant shifts in the maritime industry: decarbonization. Global regulations, such as those set by the International Maritime Organization (IMO), are forcing shipping lines to invest heavily in ships that reduce greenhouse gas emissions. These new vessels often utilize alternative fuels like LNG (Liquefied Natural Gas), methanol, or are designed for future ammonia propulsion.

Potential Upside for HD HHI

- •Revenue and Backlog Security: A confirmed mega-order would secure revenue streams for years, providing stability and predictability in a cyclical industry.

- •Technological Leadership: Successfully delivering a large fleet of green vessels would solidify HD HHI’s reputation as a leader in advanced, high-value shipbuilding, attracting further premium orders.

- •Enhanced Market Valuation: Positive news of this magnitude would almost certainly boost investor sentiment, potentially leading to a significant re-rating of the company’s stock and an improved HD HHI investment outlook.

Navigating Potential Risks and Uncertainties

Despite the optimism, caution is warranted. The primary risk is non-finalization; if the deal collapses, the market’s disappointment could trigger a sharp stock price correction. Furthermore, the final contract terms are unknown. Key details regarding pricing, profit margins, and payment schedules will determine the deal’s actual financial benefit. Rising steel prices and labor costs could also erode profitability, even on a large order.

An Investment Strategy for HD Hyundai Heavy Industries Stock

For those considering an HD HHI investment, a measured and informed approach is essential. The period leading up to the November 2025 disclosure will likely see increased stock volatility based on rumors and speculation. A prudent strategy involves thorough due diligence beyond this single potential contract.

Investor Checklist: What to Monitor

- •The Official Re-disclosure: This is the most critical event. On or before November 14, 2025, check for confirmation and analyze the disclosed terms: total contract value, number of vessels, delivery dates, and client identity.

- •Brokerage Reports & Industry Analysis: Seek out professional analysis on HD HHI and the broader shipbuilding industry trends. These reports provide context on market expectations and peer performance.

- •Company Fundamentals: Look at HD HHI’s existing order backlog, debt levels, and quarterly earnings reports. A strong fundamental base makes the company more resilient, regardless of this single deal’s outcome.

- •Market Context: Stay informed about global trade volumes and the overall health of the shipping industry. For more information, you can read about The Future of Global Shipbuilding.

Conclusion: A Defining Moment

The rumored eco-friendly container ship orders represent a potential watershed moment for HD Hyundai Heavy Industries. A successful deal would not only provide a massive financial boost but also cement its status as a premier builder for the next generation of green shipping. However, the ‘unconfirmed’ status is a crucial caveat. Investors should embrace a strategy of vigilant optimism, closely monitoring official announcements and conducting comprehensive research to make an informed decision when the final details are revealed.