As the highly anticipated CLASSYS Inc. Investor Relations (IR) event approaches on November 17, 2025, all eyes are on the global leader in the aesthetic medical device market. This event is more than just a financial report; it’s a critical moment for the company to showcase its Q3 earnings, unveil key management updates, and articulate its future CLASSYS growth strategy. For investors, this is the prime opportunity to gauge the company’s trajectory and make informed decisions.

This comprehensive CLASSYS stock analysis, based on the latest data and market trends, will dissect the key takeaways from the upcoming IR, evaluate corporate fundamentals, and explore the potential impacts on your investment portfolio. Join us as we explore the present value and future potential of CLASSYS Inc.

The Pivotal IR Event: What Investors Need to Know

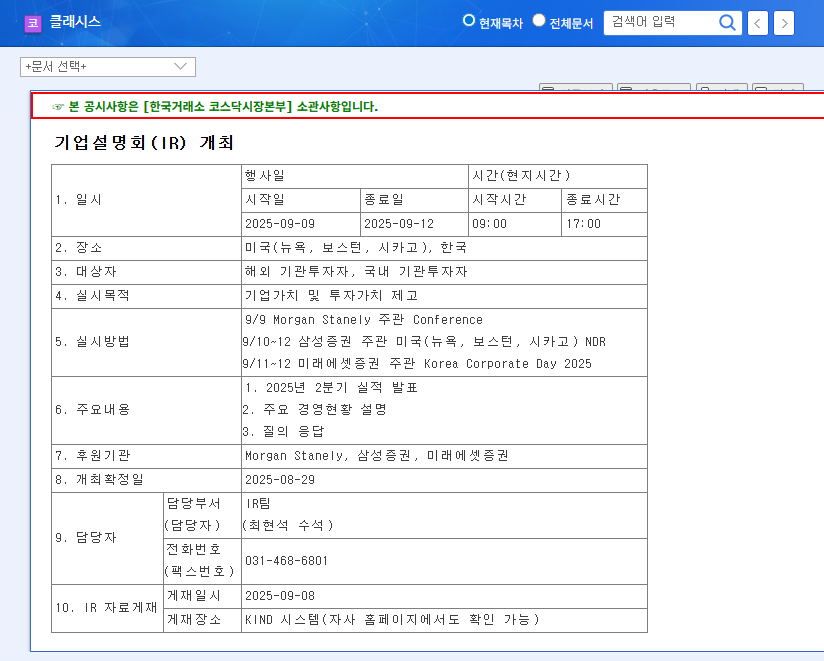

CLASSYS Inc. (KOSDAQ: 214150) has scheduled its formal Investor Relations (IR) conference for 9:00 AM on November 17, 2025. The core purpose of this event is to transparently communicate with the market to enhance corporate and shareholder value. The agenda is packed with crucial information, including the official 2025 CLASSYS Q3 earnings announcement, a detailed explanation of key management initiatives, and an interactive Q&A session. This is a must-watch event for anyone conducting a thorough CLASSYS stock analysis.

With record-breaking revenue and a strategic expansion into new markets, CLASSYS is poised for significant growth. The upcoming IR event will be the ultimate litmus test of its long-term strategy and execution capabilities.

Unpacking the Fundamentals: A Story of Robust Growth

Exceptional Revenue and Profitability

A review of the H1 2025 semi-annual report reveals a company operating at peak performance. CLASSYS isn’t just growing; it’s growing profitably and at an impressive scale. The numbers speak for themselves:

- •Record Revenue: Consolidated revenue soared to KRW 160.3 billion, a staggering 47% increase year-over-year. This growth was largely fueled by a 71% surge in overseas sales, driven by flagship products like the Shrink Universe (HIFU treatment) and Volnewmer (RF treatment).

- •High Profitability: Operating profit climbed 42% to KRW 81.7 billion. The company maintains an enviable operating profit margin of 50.9%, a testament to its premium brand positioning and efficient cost management. The rising proportion of high-margin consumables revenue is a key positive indicator of future earnings stability.

Strategic Expansion and Financial Stability

Beyond strong sales, CLASSYS is fortifying its future through smart acquisitions and diversification. Its financial health provides a solid foundation for these ventures. The acquisition of Eruida significantly bolsters its position in the competitive microneedle RF market. Furthermore, the establishment of a subsidiary clinic business signals a strategic move to diversify its portfolio and gain direct market insights. Financially, the company is rock-solid, with its debt-to-equity ratio improving to a very healthy 26.7%.

Market Impact and Investment Strategy

Potential Catalysts (The Bull Case)

The upcoming CLASSYS Inc. Investor Relations event could positively influence the stock price if the company delivers on several key points:

- •Strong Q3 Earnings: Another quarter of robust earnings, especially continued strength in overseas markets, would reaffirm the company’s growth narrative.

- •Clear Strategic Vision: A compelling explanation of the synergies from the Eruida merger and the business plan for the new clinic subsidiary would boost investor confidence.

- •Confident Q&A Session: Decisive and clear answers from management can dissolve uncertainties and reinforce the investment thesis.

Potential Risks to Monitor (The Bear Case)

Investors should remain vigilant of potential headwinds. The primary risks include CLASSYS Q3 earnings falling short of high market expectations, which could trigger a sell-off. Additionally, macroeconomic factors such as unfavorable exchange rate movements or rising interest rates could temper overseas growth. Finally, any signs of intensifying competition in the global aesthetic medical device market or uncertainty around new business ventures could dampen sentiment. For an overview of market trends, investors often consult resources like Bloomberg’s market analysis.

Conclusion: An Actionable Investment Outlook

CLASSYS Inc. presents a compelling investment case built on powerful fundamentals, strong international growth, and strategic diversification. The November 17 IR event is a critical juncture for validating this narrative.

Our investment opinion remains a Buy, but with a recommendation for a cautious approach. The most prudent strategy is to thoroughly analyze the outcomes of the IR event before committing new capital. A positive earnings report and a clear vision from management could serve as a powerful catalyst for the stock. Investors seeking the original filing can view the Official Disclosure on DART.