What Happened?

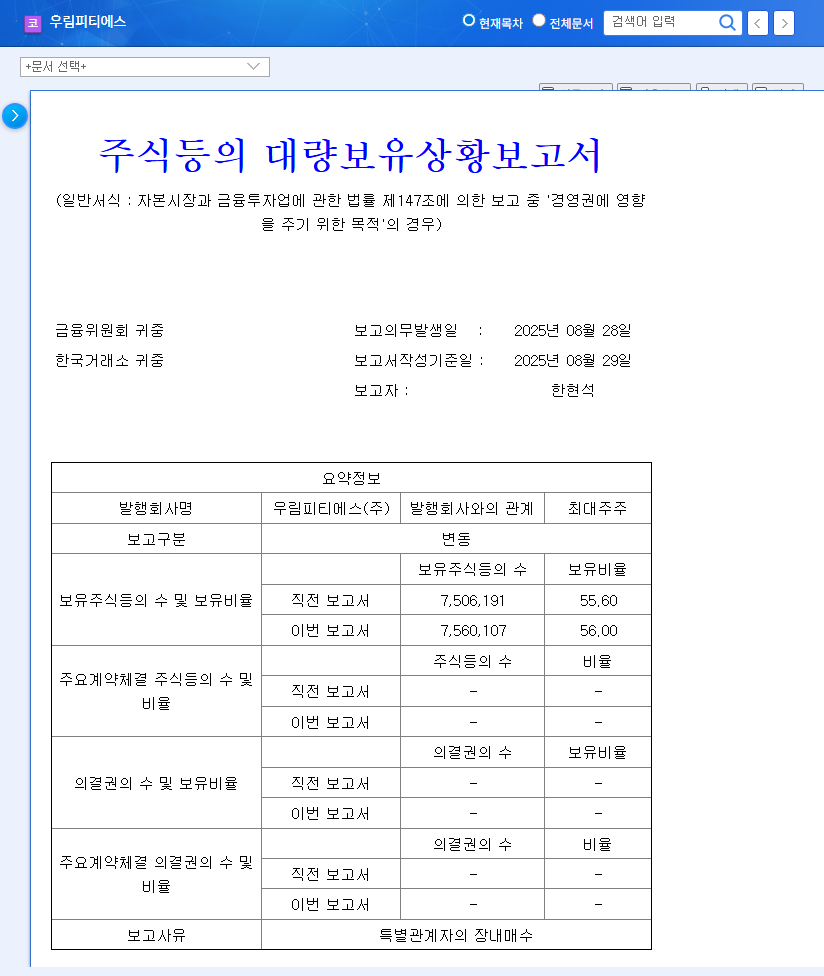

A special relationship stakeholder of Woorim PTS, Han Hyun-seok and one other, increased their stake from 56.00% to 56.15% through an on-market purchase on September 4th. The disclosed report states the purpose of the stake increase as “influence over management.”

Why Does the Stake Increase Matter?

Securing a stake exceeding 56% solidifies management control and lays the groundwork for stable business operations. This is particularly crucial for Woorim PTS, which experienced weak first-half results, as securing management stability can be key to restoring investor confidence.

How Will the Stake Increase Affect the Stock Price?

In the short term, the stake increase could improve investor sentiment, attract buying interest, and drive up the stock price. However, in the long term, the company’s fundamental improvements will determine the stock price direction. Key factors to watch include the realization of R&D investment outcomes, earnings improvement, and shareholder-friendly policies.

What Should Investors Do?

- Positive factors: Management stabilization, increased R&D investment, potential benefits from high-growth industry growth.

- Potential risk factors: Continued short-term sluggish performance, raw material price volatility, exchange rate fluctuations, debt ratio management.

Instead of focusing solely on short-term stock price fluctuations, it’s crucial for investors to continuously monitor the company’s fundamental improvements and develop investment strategies from a long-term perspective.

FAQ

What is Woorim PTS’s main business?

Woorim PTS manufactures gearboxes for construction equipment, defense, aviation, robotics, steelmaking equipment, and industrial applications.

Why is this stake increase significant?

It’s interpreted as a move to strengthen management control and establish a foundation for stable business operations, particularly as part of an effort to overcome weak first-half performance.

What precautions should investors take?

Despite the potential for short-term stock price gains, investors should carefully monitor factors such as continued earnings improvement, R&D investment outcomes, and external environment changes.