In the dynamic world of stock market investing, few events generate as much excitement as a significant ‘earnings surprise.’ This occurs when a company’s financial results dramatically outperform analyst expectations, often signaling robust health and future potential. For Q3 2025, AVACOCO.,LTD. (083930), a key player in display and secondary battery equipment, has done just that, capturing the market’s attention with preliminary results that shattered consensus forecasts. This comprehensive AVACOCO stock analysis will dissect the factors behind this stellar performance, evaluate the company’s fundamentals, and outline a forward-looking investment strategy.

This isn’t just a minor beat; it’s a fundamental shift from projected losses to significant profitability, demanding a closer look from every serious investor.

Q3 2025 Earnings: A Surprise Beyond All Expectations

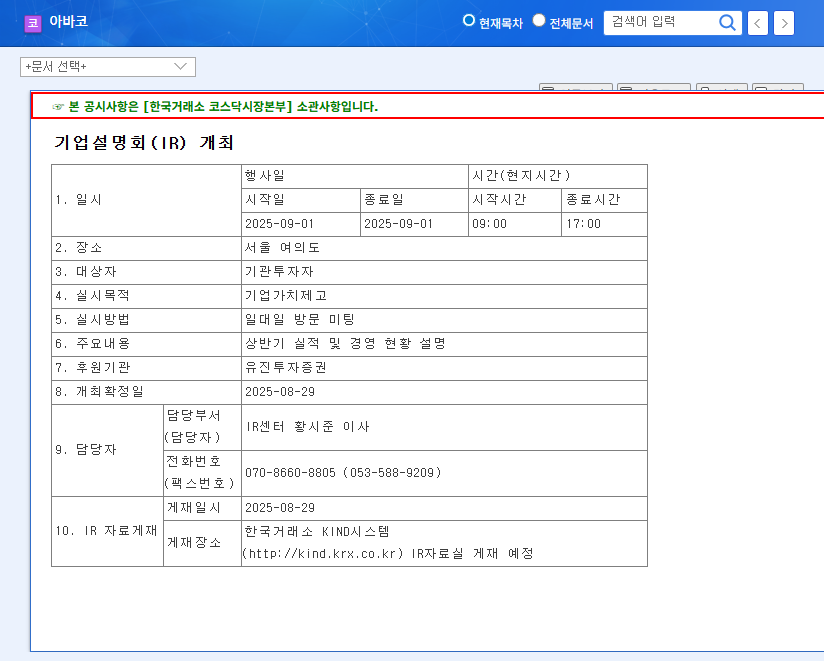

On November 3, 2025, AVACOCO.,LTD. (083930) released its preliminary Q3 earnings, triggering a wave of optimism. The numbers didn’t just exceed estimates—they represented a complete turnaround, painting a picture of a company hitting its stride. All data is sourced directly from the company’s official report filed with the DART system. You can view the full details here: Official Disclosure.

The key figures that defined this earnings surprise are:

- •Revenue: 50.3 billion KRW, a staggering 32% increase over the 38.1 billion KRW estimate.

- •Operating Profit: 6.1 billion KRW, representing a monumental 252% beat compared to the projected loss of -4.0 billion KRW.

- •Net Profit: 8.4 billion KRW, an incredible 327% surprise versus the estimated loss of -3.7 billion KRW.

The turnaround to profitability in both operating and net income is the most significant takeaway. It indicates powerful operational leverage and effective cost management, signaling a new chapter for AVACOCO.,LTD. (083930).

Deep Dive into AVACOCO.,LTD. (083930) Fundamentals

What forces propelled this outstanding performance? A detailed look at the company’s fundamentals reveals a combination of strategic positioning and powerful market tailwinds.

Positive Factors: The Engines of Growth

- •Dominance in Display Technology: With LCD and OLED equipment sales forming nearly 80% of revenue, this segment is the company’s powerhouse. Major investments in 8.6-generation display technology by giants like China’s BOE are creating a surge in demand that AVACOCO is perfectly positioned to capture.

- •Surging Secondary Battery Demand: The global shift to electric vehicles (EVs) has ignited the secondary battery market. AVACOCO’s manufacturing equipment segment has grown its revenue share to over 13% and is poised for further expansion, especially with the completion of its new TANDEM ROLL PRESS MACHINE technology and a new factory coming online. This is a critical growth vector for the future. You can learn more about trends in the secondary battery market here.

- •Strategic Diversification: Beyond its core markets, AVACOCO is wisely expanding into other high-tech fields like semiconductors, MLCCs, and 3D printers. This foresight ensures the company is not overly reliant on a single industry and is building multiple future revenue streams.

Challenges and Risks to Monitor

- •Inventory Management: While a sign of anticipating future orders, high inventory levels tie up capital and require efficient management to avoid obsolescence and improve turnover.

- •Currency & Macroeconomic Headwinds: With significant international business, the company is exposed to foreign exchange volatility. Furthermore, global factors like fluctuating interest rates can impact capital costs and overall investor sentiment.

- •R&D Investment: A recent trend shows a decreasing ratio of R&D spending to revenue. To maintain its technological edge, the company must recommit to robust R&D investment.

Investment Outlook: ‘Buy’ with Vigilance

The Q3 earnings surprise from AVACOCO.,LTD. (083930) is a powerful bullish signal. The results confirm the strength of its core business segments and showcase impressive operational efficiency. This is expected to provide significant positive momentum for the stock price and dramatically improve investor confidence.

Based on this comprehensive AVACOCO stock analysis, our overall investment opinion is a ‘Buy.’

- •Short-Term Outlook: Expect a favorable market reaction and positive stock price movement as the market digests the scale of this earnings beat. The improved profitability metrics make the current valuation highly attractive.

- •Long-Term Outlook: The growth trajectory remains strong, fueled by sustained demand in the display and EV battery markets. However, a successful long-term investment strategy requires diligent monitoring of the risks outlined above, particularly inventory levels and R&D spending.

Investors should view these results as a strong validation of AVACOCO’s business model while remaining mindful of external risks when making final investment decisions.