Daewon Pharmaceutical (DAEWON PHARMACEUTICAL CO.,LTD) faces a pivotal moment. Following a shocking decline in profitability in the first half of 2025, the company is set to hold a crucial Corporate Briefing (IR) for institutional investors on November 17th. This event is more than a standard financial update; it’s a critical opportunity for management to address widespread investor anxiety and chart a new course for growth. The central question is whether the promise of its new drug pipeline, spearheaded by DW-4421, can overshadow the current financial turmoil.

This comprehensive analysis dissects the key factors shaping Daewon Pharmaceutical’s present challenges and future potential. We will delve into the root causes of the earnings slump, evaluate the significance of the upcoming Daewon Pharmaceutical IR, and assess the true value of its R&D pipeline to provide investors with a clear, actionable perspective.

Unpacking the 2025 Earnings Shock

The H1 2025 financial results for Daewon Pharmaceutical presented a paradox: while consolidated revenue saw a minor increase of 1.7% to 301.688 billion KRW, profitability fell off a cliff. This divergence signals deep-seated operational and market-related issues that demand scrutiny.

The Core of the Problem: Profitability Collapse

- •Operating Profit Plunge: A staggering 71.7% year-over-year decline to 7.998 billion KRW. This was primarily driven by a 20.3% production volume decrease for cornerstone products like Pelubi and Codewon Forte.

- •Net Profit Annihilation: An 84.5% drop to just 1.396 billion KRW, underscoring the severity of the financial strain and raising red flags for investors.

- •Cosmetics Segment Drag: The company’s diversification efforts have faltered, with the cosmetics division revenue collapsing by 51.2%, significantly weighing down the consolidated results.

With profitability in freefall despite stable revenue, the upcoming Daewon Pharmaceutical IR must provide a convincing narrative that goes beyond surface-level explanations and offers a concrete, data-backed recovery strategy.

The New Drug Pipeline: A Beacon of Hope?

Amid the bleak financial performance, Daewon Pharmaceutical’s consistent investment in research and development stands out as a positive signal. The R&D-to-sales ratio has edged up to 8.21%, indicating a firm commitment to securing future growth engines. The crown jewel of this effort is the gastrointestinal drug candidate, DW-4421.

Having reached the Phase 3 Investigational New Drug (IND) application stage, DW-4421 is nearing the final hurdle before potential commercialization. A successful Phase 3 trial, a process rigorously overseen by regulatory bodies like the FDA in the United States, could be a transformative catalyst for the company. It represents a potential multi-billion KRW revenue stream that could not only offset the decline in legacy products but also significantly re-rate the company’s valuation in the market.

Investor Focus for the Upcoming Daewon Pharmaceutical IR

The November 17th briefing is a make-or-break event. Investors will be looking for transparent answers and a clear vision. The success of the IR will hinge on management’s ability to address these critical areas:

Key Questions and Expectations

- •Profit Recovery Roadmap: What specific, actionable steps are being taken to reverse the margin compression and revive the production of key pharmaceuticals?

- •DW-4421 Commercialization Strategy: Beyond the clinical trial status, what is the detailed timeline, target market, and go-to-market strategy for DW-4421?

- •Financial Discipline: How does the company plan to manage its rising debt-to-equity ratio (now 110.2%) and the associated interest burden in a challenging macroeconomic environment?

- •Diversification Strategy Review: What are the plans for the underperforming cosmetics and health food segments? Will there be a restructuring or a strategic pivot?

Comprehensive Assessment and Investor Takeaway

Currently, a “Neutral” stance on Daewon Pharmaceutical is prudent. The severe short-term headwinds from the Daewon Pharmaceutical earnings report cannot be ignored. However, the long-term potential encapsulated in the new drug pipeline provides a compelling reason to remain watchful.

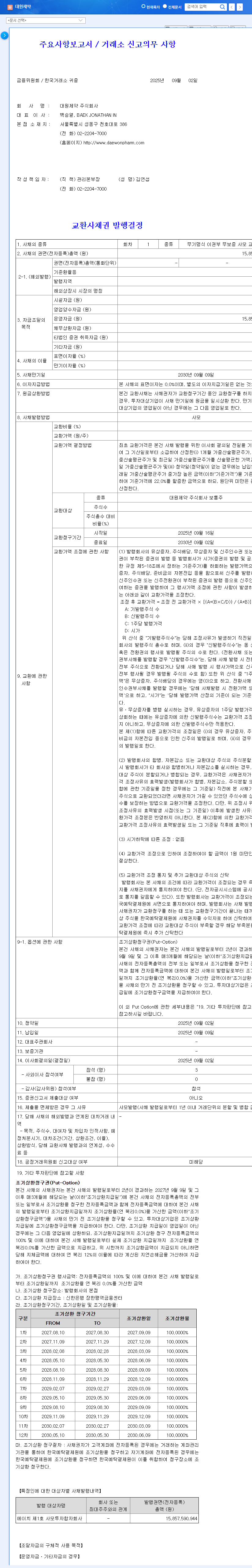

Investors should closely monitor the IR for a detailed Q3 analysis and a realistic outlook for Q4 and 2026. The company’s ability to articulate a clear strategy for improving its financial structure will be just as important as the updates on DW-4421. For further details on the company’s official filing, please refer to the Official Disclosure on DART. The outcome of this IR, combined with subsequent market reaction, will determine if the investment thesis can be upgraded. For more background, you can review our previous coverage of Daewon’s Q1 results.

The management’s communication style—whether it is confident and transparent or defensive and vague—will be a critical intangible factor in rebuilding trust. The investment opinion will be re-evaluated based on the substance and clarity of the information presented.