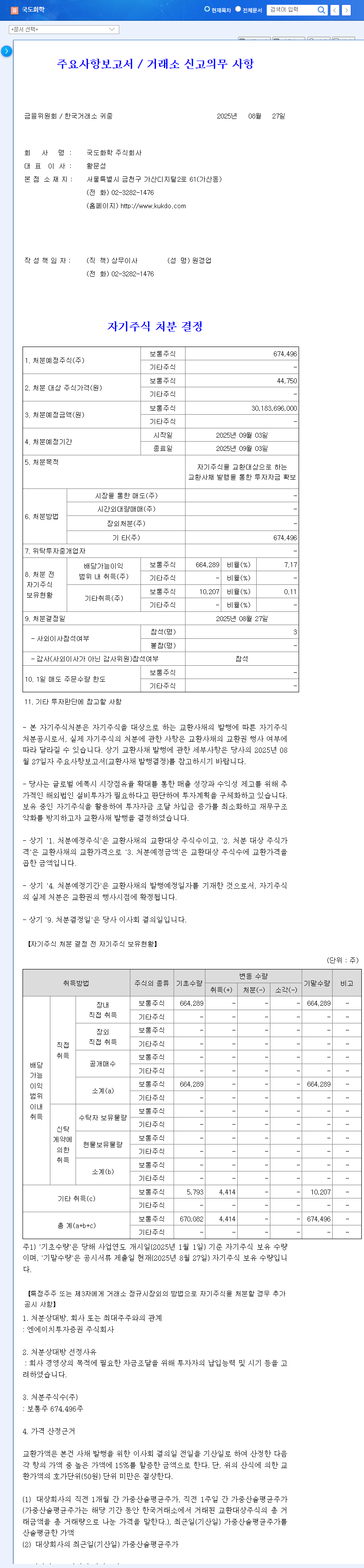

KUKDO Chemical Decides on ₩30.2 Billion Treasury Stock Disposal

On August 27, 2025, KUKDO Chemical decided to dispose of 674,496 common shares (7.28% of outstanding shares), equivalent to ₩30.2 billion. This move aims to secure investment funds through the issuance of exchangeable bonds.

Why the Treasury Stock Disposal?

Despite maintaining stable sales in epoxy and polyol businesses, KUKDO Chemical faces challenges in its polyol segment due to the global economic downturn. The funds secured through this disposal will be used for investments in new growth engines, strengthening R&D, and improving the financial structure.

Impact on Investors

- Positive Aspects: Potential for long-term corporate value increase through investment expansion and improved financial structure.

- Negative Aspects: Potential stock dilution upon conversion of exchangeable bonds and uncertainty surrounding bond issuance conditions.

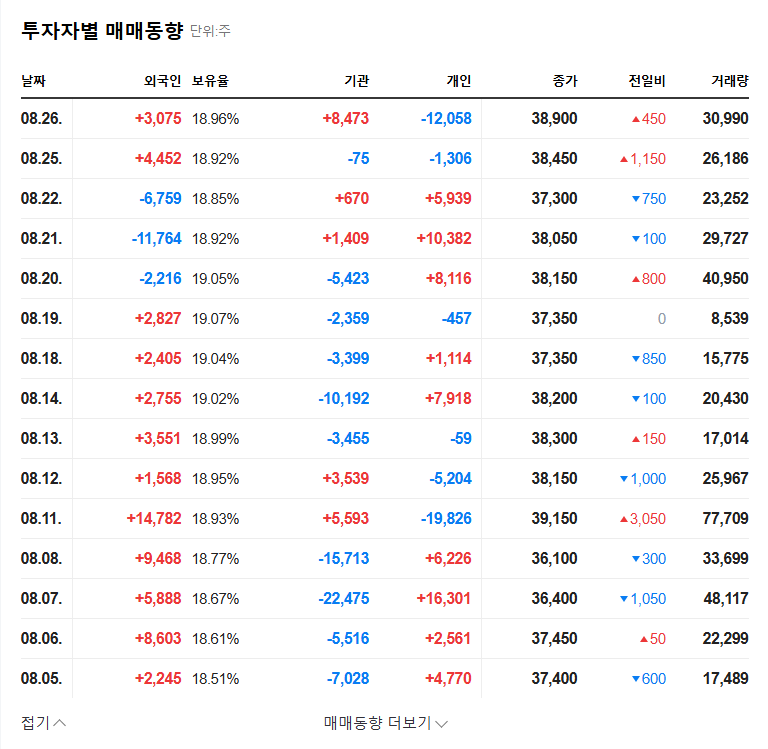

Short-term stock price volatility is expected. The mid-to-long-term impact will depend on the efficient use of the secured funds and the turnaround of the polyol business. External factors like exchange rate and interest rate fluctuations should also be monitored.

Investment Strategy: 3 Key Points

- Cautious Approach: Avoid impulsive reactions to short-term price fluctuations and make investment decisions after the disclosure of detailed information, including bond conditions.

- Analysis after Information Confirmation: Thoroughly review the exchangeable bond conditions and comprehensively evaluate the dilution effect and funding efficiency.

- Monitor Fundamental Changes: Continuously monitor positive factors like entry into the Indian market and R&D investments, along with external risk factors.

Frequently Asked Questions

How does treasury stock disposal affect stock prices?

In the short term, increased stock supply may put downward pressure on prices, but in the long term, securing funds for corporate growth can positively influence stock prices.

What are exchangeable bonds?

Exchangeable bonds are bonds that grant the right to exchange them for the issuing company’s stock.

What is the outlook for KUKDO Chemical?

The efficient use of the secured funds and the turnaround of the polyol business will be crucial factors in determining KUKDO Chemical’s future outlook.

Leave a Reply