1. What Happened? Analyzing KSP’s ₩21.2 Billion Investment

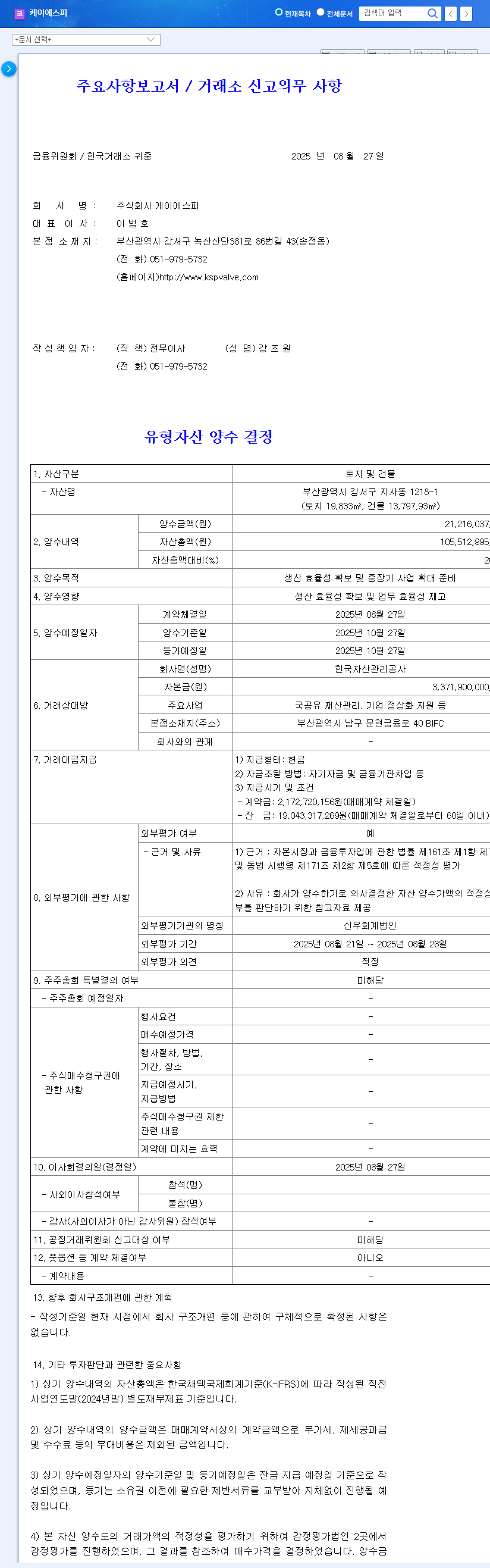

On August 27, 2025, KSP announced its decision to acquire land and buildings located in Jisa-dong, Gangseo-gu, Busan, for ₩21.2 billion. This represents 20.11% of the company’s total assets and will be financed through internal funds and loans from financial institutions.

2. Why This Decision? Background and Objectives

KSP aims to secure production efficiency and establish a foundation for mid-to-long-term business expansion through this investment. They anticipate enhanced business competitiveness through expanding facilities to handle increasing production volume and efficient space utilization.

3. What’s Next? Analyzing Positive & Negative Impacts

Positive Aspects:

- Increased production and operational efficiency

- Foundation for mid-to-long-term business expansion

- Potential for improved financial structure

Negative Aspects:

- Increased short-term financial burden (increased debt and interest expenses)

- Questions about the timing of the investment (considering current poor performance)

- Uncertainty about meeting market expectations

4. What Should Investors Do? Short-Term & Long-Term Investment Strategies

Short-Term Investment Strategy:

- Maintain a wait-and-see approach, monitoring financing methods and performance improvements

- Recommend observing trends rather than new purchases

Long-Term Investment Strategy:

- Monitor asset utilization and business performance

- Check for financial soundness recovery

- Analyze the outlook for the shipbuilding and related industries

- Evaluate valuation attractiveness

Frequently Asked Questions

What are KSP’s main businesses?

KSP’s main businesses are engine parts and forging & forming. The engine parts business, in particular, is highly influenced by the shipbuilding industry’s performance.

Will this investment decision positively impact the stock price?

In the short term, concerns about increased financial burden could negatively affect the stock price. However, if the investment proves successful and leads to improved performance in the long term, a positive impact can be expected.

What should investors be cautious about?

Investors should closely monitor the financing methods, especially the level of increased debt and changes in interest expenses. It’s also crucial to track how effectively the assets contribute to increased production efficiency and new business expansion, and how this translates into financial performance.

Leave a Reply